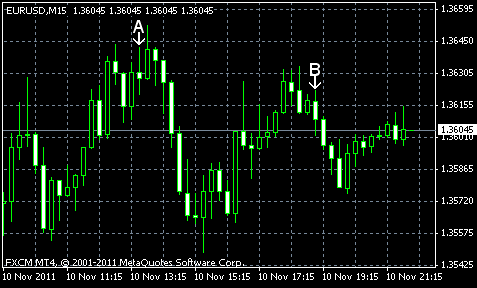

EUR/USD rose today after Standard & Poor’s confirmed France’s top AAA credit rating, following the message about a downgrade of the rating that was sent because of a technical error. Fundamentals remained negative for the euro, though. Yield on French 10-year bonds surged, adding to concerns about the European crisis. The data from the US was more beneficial to the dollar than to the euro as the reports were better than forecasts for the most part.

US trade balance deficit shrank to $43.1 billion in September from $44.9 billion in August, instead of widening to $46.1 billion as was predicted. (Event A on the chart.)

Initial jobless claims fell to 390k from 400k last week, while they were expected to stay almost unchanged at 401k. (Event A on the chart.)

Import and export prices declined in October. Import prices fell 0.6%, compared to the expected 0.1% increase, while September change was revised to 0.0% (no change) from the 0.3% growth. Export prices slumped 2.1%, posting the biggest drop since December 2008. (Event A on the chart.)

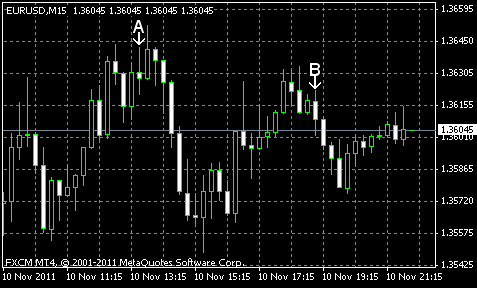

Treasury budget deficit was $98.5 billion in October. That’s bigger deficit than was in September ($61.5 billion), but smaller compared to forecasts of $107.5 billion. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.