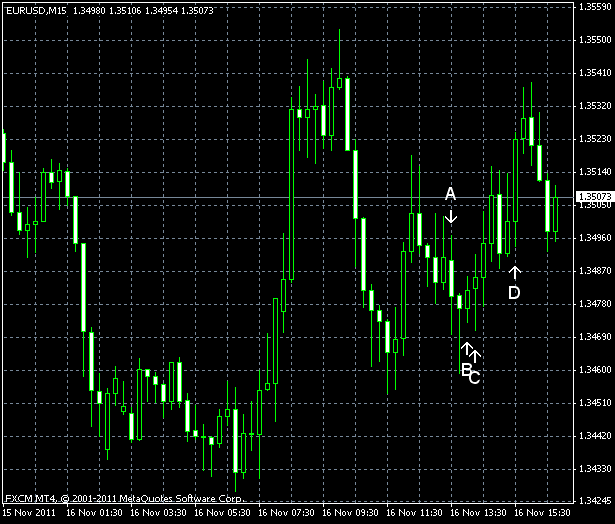

EUR/USD extended its downfall today as yield on sovereign bonds of the European Union nations continued to rise. The currency pair is currently rising and has potential to erase its losses. The data from the USA was again good with the exception of the inflation that unexpectedly declined.

CPI decreased 0.1% in October on a seasonally adjusted basis, following the 0.3% increase in September. Analysts expected no change. (Event A on the chart.)

Net foreign purchases were $68.6 billion in September. Economists thought they would rise just to $63.4 billion from August value of $58.0 billion. (Event B on the chart.)

Industrial production and capacity utilization rate improved in October. Industrial production expanded 0.7% after the decline by 0.1% in September, compared to predicted 0.4%. Capacity utilization rate edged up to 77.8 percent, compared to September figure of 77.3% and the median forecast of 77.6%. (Event C on the chart.)

US crude oil inventories decreased by 1.1 million barrels from the previous week and are in the upper limit of the average range for this time of year. Total motor gasoline inventories increased by 1.0 million barrels last week and are in the middle of the average range. (Event D on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.