- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: November 17, 2011

November 17

November 172011

Ringgit Remains Lower Even as Risk Aversion Eases

The Malaysian ringgit remains down on today’s trading session even as good news from Europe eased risk aversion sentiment among Forex traders. Pessimism ruled the Forex market at the start of the session as Spain’s borrowing costs surged. Tensions eased after Franc auctioned its debt, showing lower yield. Some currencies profited from the positive news, but the ringgit wasn’t among them. Uncertainty about the future development of the situation […]

Read more November 17

November 172011

Canadian Dollar Finds Strength as Eurozone Fears Ease

Canadian dollar is gaining strength for the first time in days as some of the fear over the eurozone dissipates. Loonie has been struggling, in spite of relatively sound fundamentals, on sentiment related to the eurozone. Today, though, some of the fear related to the eurozone is easing as the news circulates that the ECB has bought more Italian bonds in an effort to help keep the bond yield down. Additionally, demand for loonie-denominated securities remains reasonably high. Canada […]

Read more November 17

November 172011

US Dollar Lower as Markets take a Breather

US dollar is lower as markets take a breather, showing signs of optimism after a tense couple of days. Stocks in Europe are still struggling, but US stock futures are in the black, hopeful on positive US economic data. Jobless claims data is reasonably positive, with new claims down to 388,000, and housing market data is better than many expected as home inventories begin to drop. As a result, a little […]

Read more November 17

November 172011

Euro Heads to Five-Week Low

The euro fluctuated today, erasing its previous gains and heading to the lowest level in five weeks, after Spain’s debt auction and the warning by Fitch Ratings about the impact of the European crisis on US banks. Yield on Spain’s bonds rose at today’s auction, reinforcing concerns among Forex market participants. The Stoxx Europe 600 Index of shares retreated 0.8 percent, falling for the third session in four days. Fitch warned that the spreading European […]

Read more November 17

November 172011

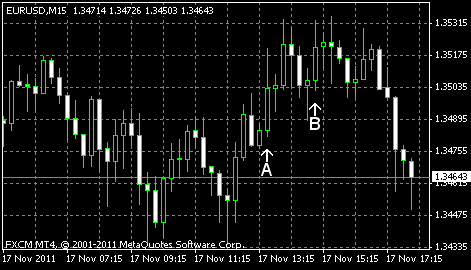

EUR/USD Doesn’t Know Where to Go

EUR/USD was rather volatile today. Initially the currency pair slid as yield on French and Spanish bonds jumped. Later French borrowing costs declined, pushing the euro higher. Currently, EUR/USD remains near its opening level, but is showing a downward pattern. Housing starts were at a seasonally adjusted annual rate of 628k in October. That’s below September estimate of 630k (revised from 658k), but above market expectations […]

Read more November 17

November 172011

AUD Higher Today After Yesterday’s Decline

The Australian dollar pared its yesterday’s decline, but the outlook for the currency is still rather pessimistic. The Australian currency extended its yesterday’s fall against the euro. France and Spain are going to auction debt today. Yield on the Eurozone bonds is the center of attention this week and market participants consider it as an indicator of the situation in Europe. Previously, soaring borrowing costs were negative for market sentiment and it’s very likely that […]

Read more