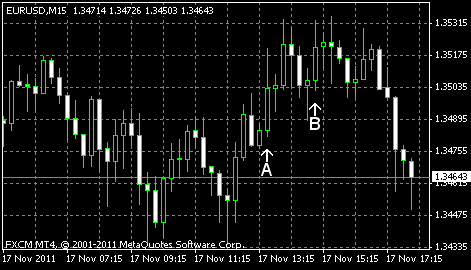

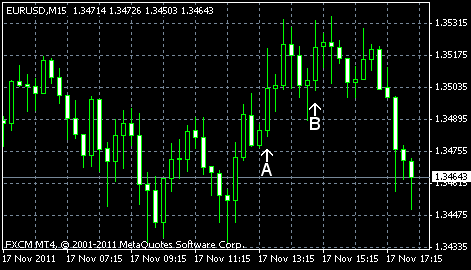

EUR/USD was rather volatile today. Initially the currency pair slid as yield on French and Spanish bonds jumped. Later French borrowing costs declined, pushing the euro higher. Currently, EUR/USD remains near its opening level, but is showing a downward pattern.

Housing starts were at a seasonally adjusted annual rate of 628k in October. That’s below September estimate of 630k (revised from 658k), but above market expectations of 610k. Housing starts were at a seasonally adjusted annual rate of 653k in October. That’s compared to the revised September rate of 589k (down from 594k in the initial estimate) and the median forecast 600k. (Event A on the chart.)

Initial jobless claims was 388k (seasonally adjusted) in the week ending November 12, down from the previous week’s revised figure of 393k. The forecast reading was 396k. (Event A on the chart.)

Philadelphia Fed index fell to 3.6 in November, while economists hoped it to stay at October level of 8.7. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.