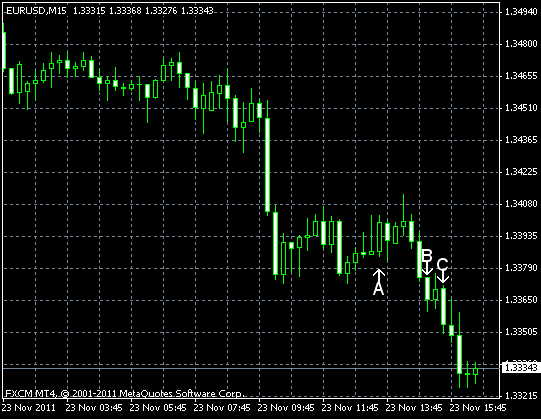

EUR/USD dropped today on the signs that the recovery in Europe stalled. Germany failed to sell 35% of its 10-year bonds, making traders question: what hope has Europe if its strongest economy has such problems with sale of its debt? The United States, on the other hand, continue to show positive signs. The increase of the jobless claims wasn’t that positive, though.

Initial jobless claims was 393k last week, near the level of the week before — 391k (revised from 388k). Market participants hoped for a reading of 389k.

Durable goods orders fell 0.7% in October, according to the advance report. That’s a smaller drop than was predicted (1.1%) and a better reading that in September (1.5%).

Personal income and spending rose in October. Income increased 0.4%, posting a bigger increase than in September (0.1%) and than was forecast (0.3%). In contrast, spending grew only 0.1%, slower than in the preceding month (0.7%) and than was expected (0.4%).

Michigan Sentiment Index rose to 64.1 in November from 60.9 in October. The figure was still below the forecast of 64.6 and slightly less the the preliminary estimate — 64.2.

Crude oil inventories decreased by 6.2 million barrels and total motor gasoline inventories increased by 4.5 million barrels last week.

If you have any comments on the recent EUR/USD action, please reply using the form below.