- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: November 30, 2011

November 30

November 302011

Loonie Surges as Central Bank Move Sinks Greenback

Earlier, several central banks announced coordinated action to keep US dollars cheaper. The move has prompted a gain in risk appetite that is helping the Canadian dollar today on the Forex market. Central banks in the US and Europe, as well as the Bank of Japan, decided to extend the policy of dollar swaps that contribute to some of the liquidity of the world’s money supply. As a result of the move, the US dollar is plunging. Demand for high beta currencies, including […]

Read more November 30

November 302011

US Dollar Plummets on Central Bank Coordination

US dollar is down across the board on the latest move by the world’s major central banks to increase liquidity. In an effort to inject confidence in global markets, several central banks are coordinating efforts to make the US dollar cheaper. Worried about another credit squeeze, several central banks, including the Federal Reserve, European Central Bank, Bank of England, Bank of Japan, Swiss National Bank and the Bank of Canada, are coordinating efforts […]

Read more November 30

November 302011

Brazilian Real Gains Despite Dovish Outlook

The Brazilian real gained today despite the speculation that the central bank will be forced to cut the interest rates further as the global economic growth stalls. China decreased the required amount of cash that banks should keep as reserves. Economists think that the most likely reason for such decision is the concern that the slowing world economy will hurt the nation’s exports. That’s just one of the signs that China expects […]

Read more November 30

November 302011

Forint Goes Down, More Interest Rate Hikes Expected

The Hungarian forint fell today even though the nation’s central bank increased interest rates, prompting the speculation that more rate hikes will be performed in the future. The Magyar Nemzeti Bank (the central bank of Hungary) boosted its two-week deposit rate from 6 percent to 6.5 percent yesterday. Bank’s President Andras Simor said that he’s ready to increase the lending rates further, even though they are […]

Read more November 30

November 302011

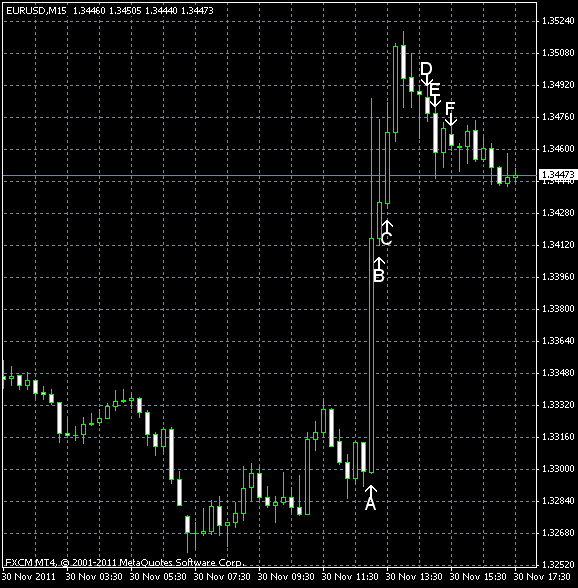

EUR/USD Surges on Unexpected Fed Announcement

EUR/USD surged today after the Federal Reserve and five other banks of developed nations announced their agreement to cut interest rates on dollar liquidity swaps. (Event A on the chart.) This measure is viewed by market commentators as a help for European banks to fund its dollar reserves. Before the announcement the currency pair was drifting sideways, as it was doing in the past two days. EUR/USD could actually brake to downside as the economic data […]

Read more November 30

November 302011

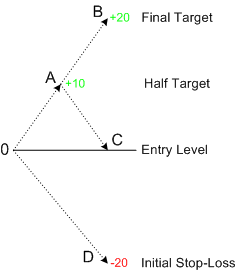

Partial Profit Taking in Forex — Does It Work?

“Cut your losses short and let your profits run.” — Proverb Introduction When a Forex traders decides to open a position, usually he has some profit target in mind. Often such target is set as a take-profit order for the position. Sometimes, traders set multiple profit targets for one position and close it partially with every profit target reached. It’s called partial profit taking or half profit targets […]

Read more November 30

November 302011

Mexican Central Bank Plans to Support Peso

The Mexican peso advanced today as the nation’s central bank pledged to support the currency in case it would decline too much. Mexico’s currency exchange commission, which is made up from representatives of the central bank and Finance Ministry, said its going to use $400 million from its $140 billion reserves in case the peso would decline more than 2 percent in one day. The Mexican currency already has […]

Read more