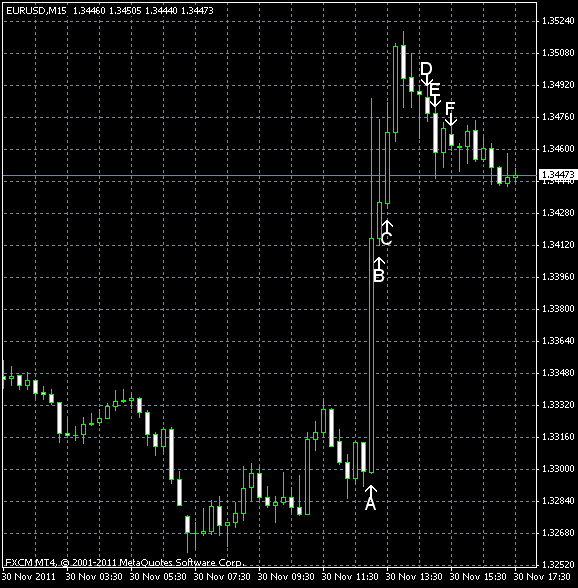

EUR/USD surged today after the Federal Reserve and five other banks of developed nations announced their agreement to cut interest rates on dollar liquidity swaps. (Event A on the chart.) This measure is viewed by market commentators as a help for European banks to fund its dollar reserves. Before the announcement the currency pair was drifting sideways, as it was doing in the past two days. EUR/USD could actually brake to downside as the economic data from the United States was significantly better than was predicted, but the surprising move by the central banks left the euro soaring. At least, for the present time.

ADP employment report showed an increase by 206k jobs from October to November. A nice figure, especially compared to the previous reading of 130k (revised from 110k) and the forecast of 131k. (Event B on the chart.)

Nonfarm productivity (revised) rose at the annual rate of 2.3% in the third quarter. The figure was near the forecast value of 2.6%. The preliminary estimate was 3.1%, while in the second quarter productivity fell 0.1%. (Event C on the chart.)

Chicago PMI was at 62.6 in November (seasonally adjusted). A small change from 58.4 in October to 85.5 was expected by market participants. (Event D on the chart.)

Pending home sales jumped 10.4% in October from September. That’s a huge improvement from the -4.6% change in September and far above the forecast reading of 1.4%. (Event E on the chart.)

Crude oil inventories increased by 3.9 million barrels from the previous week and are in the upper limit of the average range for this time of year. Total motor gasoline inventories increased by 0.2 million barrels last week and are in the middle of the average range. (Event F on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.