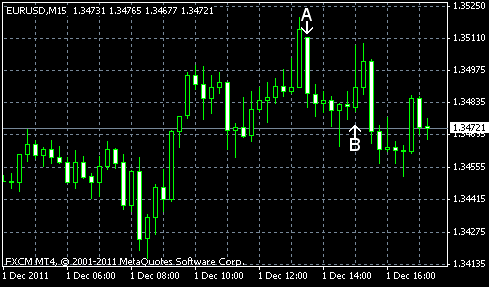

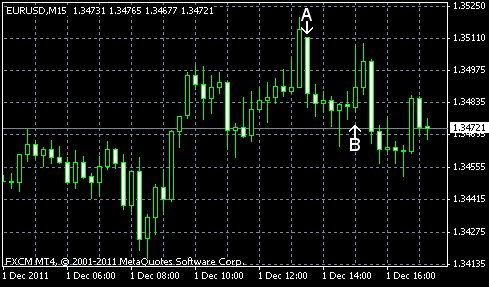

EUR/USD extended its rally after the yesterday’s surge on the announcement of the joint action of the major central banks to make dollars cheaper in swaps among banks. Today, Spain achieved the maximum target in the debt auction, while the yield on the French bonds fell. The data from the United States was positive for the most part, but the rising unemployment claims made traders concerned. The nonfarm payrolls will be released tomorrow.

Initial jobless claims rose at the seasonally adjusted rate of 402k in the week ending November 26 from the previous week’s revised figure of 396k. A figure of 390k was expected by market participants. It’s a disturbing sign as the recent improving of the US labor market was a source of optimism for the US economy, but the rising unemployment claims signal that the employment may again worsen. (Event A on the chart.)

ISM manufacturing PMI increased to 52.7% in November from 50.8% in the previous month. The median forecast was 51.6%. (Event B on the chart.)

Construction spending grew with the seasonally adjusted rate of 0.8% in October from September, which was two times about the analysts’ estimate of 0.4% and that estimate was in turn two times above the September reading of 0.2%. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.