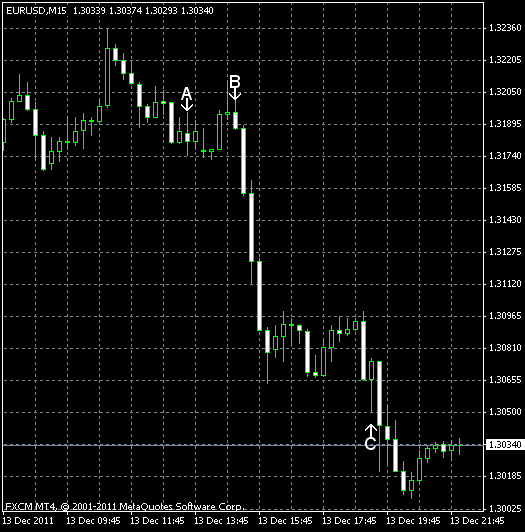

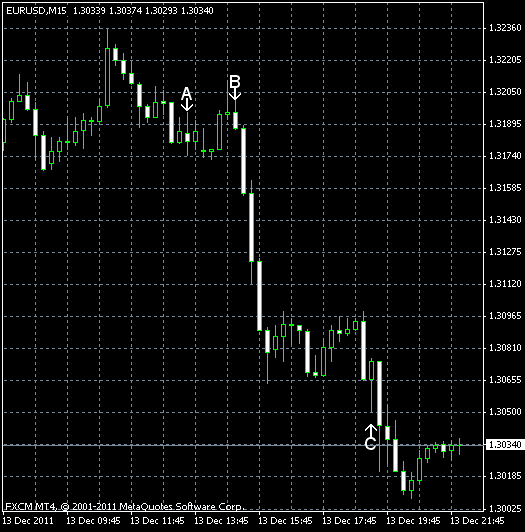

EUR/USD was trading flat at the beginning of today’s trading session, but in the second half of the session rapidly declined and remained weak as of now. The currency pair slid yesterday as Moody’s Investor Service warned about possible downgrade of the European countries’ credit ratings. The US retail sales report was worse than expected, subduing optimism about the US economic growth. The Federal Reserve signaled that it’s going to keep the interest rates exceptionally low, but didn’t mention QE3.

Retail sales increased 0.2% in November from the previous month, according to the advance report. Forecasters expected the rate of growth to remain at the same level as in October — 0.6% (revised from 0.5%). (Event A on the chart.)

Business inventories rose 0.8% in October, compared to the median forecast of 0.7%. No change was registered in September. (Event B on the chart.)

FOMC decided to keep the federal funds rate at zero to 0.25%. (Event C on the chart.) The Committee said that the economy continued to improve, but with only moderate pace, and wrote in the statement:

Economic conditions–including low rates of resource utilization and a subdued outlook for inflation over the medium run–are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013.

Yesterday, a report was released, showing that Treasury budget deficit widened to $137.3 billion in November from $95.5 billion in October. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.