- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: December 15, 2011

December 15

December 152011

Japanese Yen Stronger Against US Dollar

Japanese yen is stronger against the US dollar today. In general, dollar is down against most other currencies as optimism improves on the news that jobless claims have dropped to significantly low levels. This same optimism is also prompting the euro to gain against the Japanese yen. Better economic news out of the United States is providing some strength for the euro, as the 17-nation currency is bought as more optimistic […]

Read more December 15

December 152011

US Dollar Drops as Optimism Spurs Risk Appetite

US Dollar is falling back as Forex traders find some optimism in today’s good economic news. Jobless claims have fallen to lows not see for more than three years, and investors and traders alike are excited about the news. Jobless claims fell to 366,000, seasonally-adjusted. Yesterday, it was all about Italian debt costs, and the US dollar was higher. Today, though, the eurozone’s troubles have been […]

Read more December 15

December 152011

Euro Snaps Decline After Spanish Debt Auction

The euro ended its three-day drop against the US dollar and the Japanese yen as the outcome of Spain’s debt auction was much better than anticipated, relieving concerns about the European sovereign-debt crisis to some extent. Spain sold at the auction â¬6.03 billion of bonds today. That was almost two times above its maximum target of â¬3.5 billion. The yield on the 10-year notes rose only slightly to 5.545 percent from 5.433 […]

Read more December 15

December 152011

Franc Gains as SNB Maintains Cap

The Swiss franc climbed today after Philipp Hildebrand, Chairman of the Governing Board of the Swiss National Bank, announced that the central bank would keep the ceiling at 1.20 francs per euro and leave the main interest rate unchanged. There were many talks about possible increase of the cap for the Swiss currency. Such speculations proved untrue, at least for now, as the SNB refrained from weakening the Swissie further. Hildebrand wrote in the statement: The Swiss […]

Read more December 15

December 152011

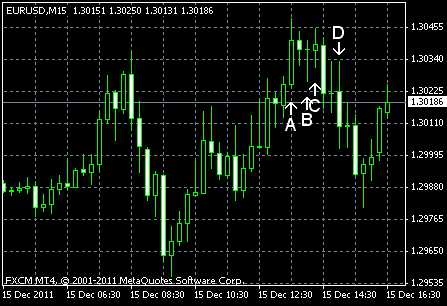

EUR/USD Ends Decline on Spanish Bond Auction

EUR/USD advanced today, ending the three-day decline, after Spain’s debt auction exceeded its maximum target. The US data today can be considered good for the most part, most notably unemployment claims that continue to fall. PPI increased 0.3% in November, exactly as forecasts promised. The index declined with the same 0.3% rate in October. (Event A on the chart.) Initial jobless claims continued to provide pleasant surprises, falling from […]

Read more December 15

December 152011

Real Dips as Brazil’s Economy Slows

The Brazilian real weakened today, following other riskier currencies in decline, on the signs that Brazil’s economy felt the negative impact of the European sovereign-debt troubles on the global economic recovery. The seasonally adjusted index of the Brazilian economic activity, which often foreshadows a change of the gross domestic product, dropped 0.32 percent in October from September, compared with the median forecast of a 0.1 percent decline. Analysts are concerned as the retail sales and industrial output […]

Read more December 15

December 152011

European Crisis Continues to Hammer Down Canadian Dollar

The Canadian dollar continued to fall as the concerns for Europe continued to intensify. The indecisiveness of the European governments makes investors ask whether the politicians have ability and willingness to address the region’s issues or they would allow the European Union to fall apart. Two major negative events occurred in Europe. First, the yield on the Italian and Spanish bonds jumped. Second, Germany refused to boost the European bailout fund. As a result, the futures on crude oil, the key Canadian export, […]

Read more