EUR/USD advanced today, ending the

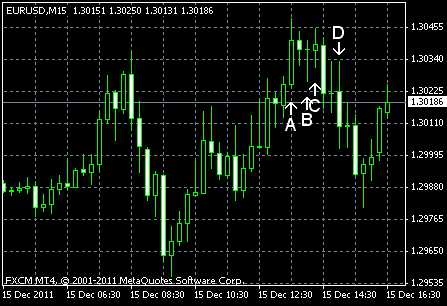

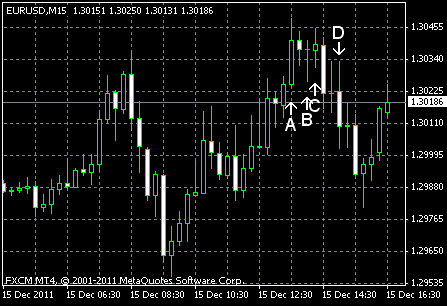

PPI increased 0.3% in November, exactly as forecasts promised. The index declined with the same 0.3% rate in October. (Event A on the chart.)

Initial jobless claims continued to provide pleasant surprises, falling from 385k to 366k, even though market analysts thought that the claims would increase to 389k. (Event A on the chart.)

US current account deficit shrank to $110.3 billion (preliminary) in the third quarter from the upwardly revised $124.7 billion in the second quarter. The figure was in line with forecast of $108 billion. (Event A on the chart.)

NY Empire State Index climbed to 9.5 in December (the highest level since May) from just 0.6 in November. The increase was much bigger than the anticipated rise to 3.1. (Event A on the chart.)

Net foreign purchases slumped to $4.8 billion in October. That’s a significant drop from the September reading of $68.3 billion and nowhere near the forecast value of $53.4 billion. (Event B on the chart.)

Industrial production and capacity utilization rate decreased in November. Industrial production fell 0.2$, instead of rising by 0.3% as was predicted. The production expanded 0.7% in October. Capacity utilization rate stood at 77.8%, near the forecast figure of 77.9% and slightly lower than 78.0% (revised from 77.8%) in the preceding month. (Event C on the chart.)

Philadelphia Fed manufacturing index jumped to 10.3 in December from 3.6 on November, being two time the forecast value of 5.1. (Event D on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.