- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: January 3, 2012

January 3

January 32012

NZD Jumps as Positive PMI Figures Spark Optimism on FX Market

The New Zealand dollar surged today as the positive reports about China’s and US manufacturing made more attractive currencies related to growth, the New Zealand one among them. The US Purchasing Managers’ Index increased from 52.7 to 53.9 in December, showing a 29th straight month of manufacturing expansion. Both the Standard & Poorâs 500 Index of shares and the MSCI World Index climbed as much as 1.8 percent today. All in all, today’s […]

Read more January 3

January 32012

Canadian Dollar Rises as Commodities Jump

Canadian dollar is higher as commodities see a sharp jump in prices. The latest ISM data in the United States is helping matters, especially for the loonie, but the manufacturing expansion in China and Australia is also helping quite a bit. With economic data improving for the United States and for other countries, optimism is running high. That means that commodity prices are improving and commodity currencies, like the loonie, are getting a boost. […]

Read more January 3

January 32012

Euro Higher, Even as Bank Lending from ECB Continues

Euro is higher today, gaining even though banks are still making high demands on the ECB’s marginal lending facility. A total of 14.8 billion euros were borrowed on Monday night. This wasn’t as much as borrowed last Thursday night, but it indicates that banks are still demanding emergency money from the ECB. Even so, the euro is higher today against most other major currencies. […]

Read more January 3

January 32012

Aussie Jumps with Asian Stocks & Manufacturing

The Australian dollar jumped today as Asian stocks advanced and nation’s manufacturing expanded, increasing attractiveness of Australia’s currency. The Manufacturing Index of Australian Industry Group rose from 47.8 to 50.2 in December. A value above 50.0 indicates expansion and Australia’s manufacturing expanded last month for the first time since June. The MSCI Asia Pacific Excluding Japan Index of stocks advanced as much as 1.7 percent. AUD/USD jumped from 1.0231 to 1.0346 (the highest […]

Read more January 3

January 32012

Dollar Drops as Manufacturing Expands in USA & China

The US dollar dropped today as expanding manufacturing in the United States and China damped demand for the greenback as a safe haven. The dollar reached the lowest level in more than a month against the yen. China’s Purchasing Managers’ Index increased from 49.0 to 50.3 in December, according to the report of the China Federation of Logistics and Purchasing on January 1. Analysts predict that the report of the Institute for Supply Management will show today an increase of PMI from 52.7 to 53.3 […]

Read more January 3

January 32012

Dollar Down on PMI & FOMC Minutes

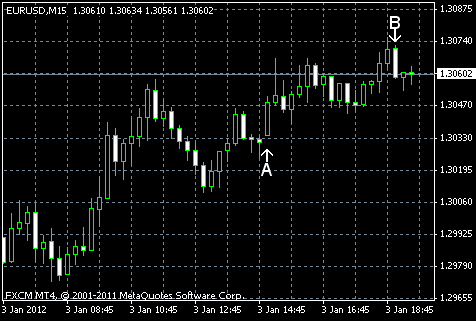

EUR/USD jumped today as China’s and US Purchasing Managers’ Index rose, while global stocks rallied, reducing demand for the dollar as a safe currency. The minutes of the FOMC meeting indicated that committee members believe that more stimulative monetary policy may be required in the future. ISM manufacturing PMI was at 53.9% in December, a bit higher than the forecast value of 53.3% and above the November reading of 52.7%. (Event A on the chart.) Construction spending […]

Read more