EUR/USD jumped today as China’s and US Purchasing Managers’ Index rose, while global stocks rallied, reducing demand for the dollar as a safe currency. The minutes of the FOMC meeting indicated that committee members believe that more stimulative monetary policy may be required in the future.

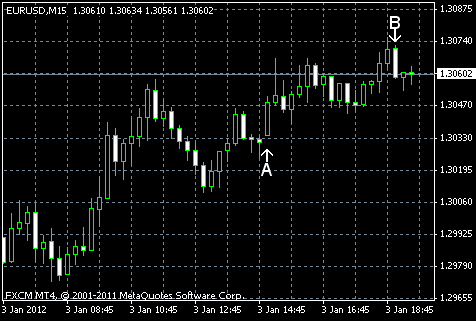

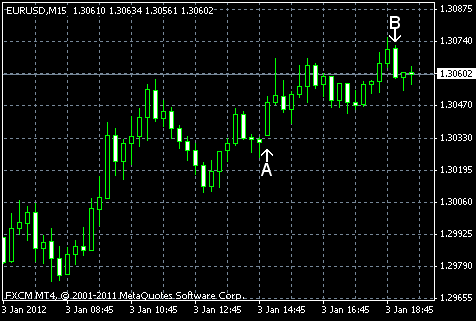

ISM manufacturing PMI was at 53.9% in December, a bit higher than the forecast value of 53.3% and above the November reading of 52.7%. (Event A on the chart.)

Construction spending expanded 1.2% in October, two times as much as was forecast — 0.6%. The September reading was revised from 0.8% to -0.2%. (Event A on the chart.)

The minutes of the Federal Open Market Committee meeting showed that the committee members considered the US economic growth to be robust, but were concerned about some problems, including the level of unemployment:

Members noted that information received over the intermeeting period pointed to somewhat stronger economic growth in the third quarter, partly reflecting a reversal of temporary factors that had depressed economic growth in the first half of the year. However, overall labor market conditions remained weak.

Some members thought that more accommodative policy may be implemented in the future, despite the positive signs, and one member thought that the current economic conditions warrant more accommodation now. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.