- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: January 5, 2012

January 5

January 52012

Yuan Drops as Central Bank Sets Reference Rate Lower

The Chinese yuan was weaker today after the nation’s central bank cut the daily reference rate on concerns that the continuing European crisis would hurt growth prospects. The People’s Bank of China cut the fixing by 0.18 percent. It stands now at 6.3115 per dollar. The cut was biggest since November 15. The yuan also dropped as fears of Europe’s crisis deterred traders from buying riskier assets. Zhu Min, […]

Read more January 5

January 52012

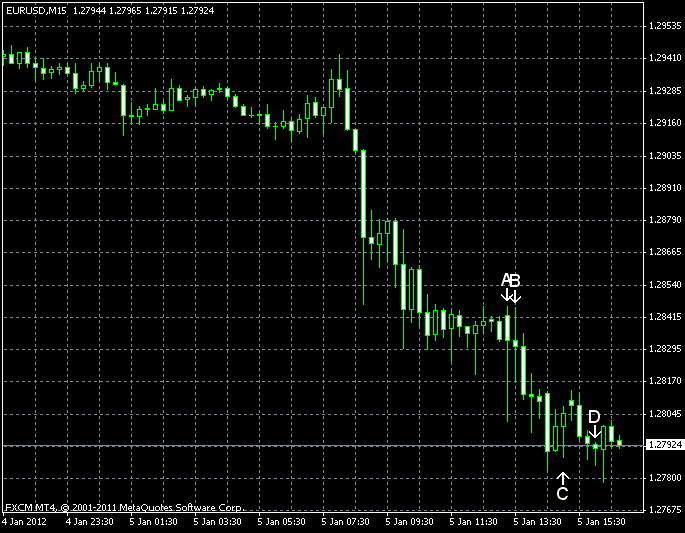

Euro Plummets as Concerns Skyrocket

Euro has plummeted below the 1.28 level against the US dollar today as concerns pile up. The latest French bond auction saw higher borrowing costs, and there are renewed concerns about a credit rating downgrade for country. On top of that, Italian banking weakness remains. It is no surprise that the euro is struggling so much today, reaching lows not seen against the Japanese yen in 11 […]

Read more January 5

January 52012

Aussie Mixed in Forex Trading

Aussie is down against the US dollar as risk aversion continues today, but up against the euro. Concerns about the eurozone crisis have sharpened, and that has investors and Forex traders alike jumpy about what could be next for the global economy. As a result, the Australian dollar is seeing gains against a weaker euro, but losses against the greenback, which is used as a safe haven. Indeed, the eurozone is […]

Read more January 5

January 52012

EUR/USD at the Lowest Since September 2010

EUR/USD dropped to the low last seen in September 2010 as concerns about the European crisis returned to the Forex market, while the US economy continued to show signs of recovery. Today’s data was good, especially the unexpected advance of employment. That allows traders to believe that nonfarm payrolls will be better than previously estimated. ADP employment climbed by 325k in December from November, proving wrong forecasters that expected a drop […]

Read more January 5

January 52012

Pound Jumps to Highest Price in More Than a Year Against Euro

The Great Britain pound jumped against the euro to the highest level in more than a year as concerns about the problems of Europe made the UK currency more appealing. The sterling also advanced versus the Swiss franc, but dropped against the US dollar. Spain had to help Valencia region with a â¬123 million payment to Deutsche Bank AG. Yield on Spain’s 10-year bonds rose 14 basis points as a result. Britain’s currency played […]

Read more January 5

January 52012

Canada’s Dollar Suffers from Risk Aversion

The Canadian dollar fell yesterday and continued its decline today against the US currency and the Japanese yen as optimism evaporated from the Forex market. Canada’s currency jumped versus the euro. This year has started with good market sentiment, which didn’t last long, though. Analysts believe that the weak demand for German bonds and the record spread for Hungary’s credit-default swaps made traders’ mood to shift in favor of risk aversion. […]

Read more