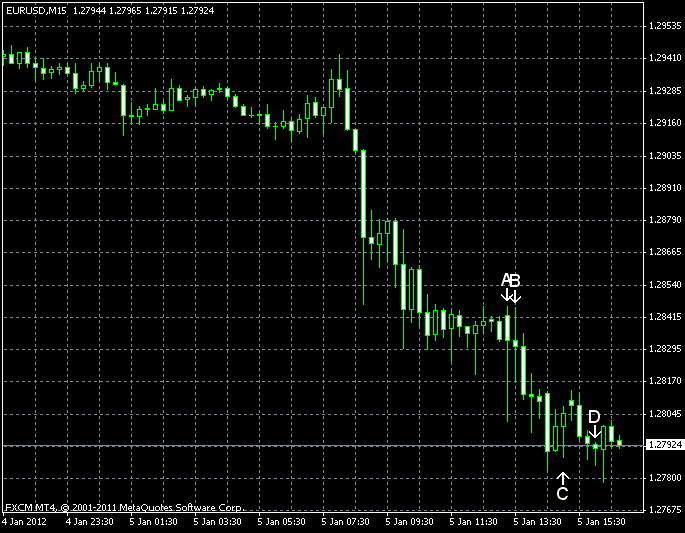

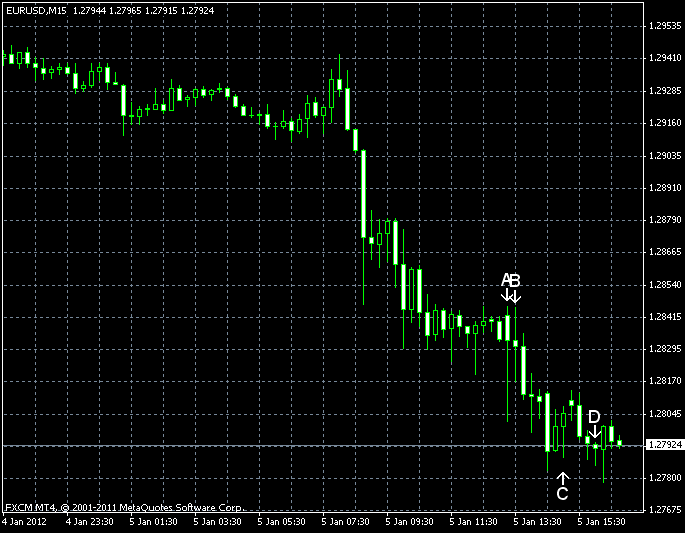

EUR/USD dropped to the low last seen in September 2010 as concerns about the European crisis returned to the Forex market, while the US economy continued to show signs of recovery. Today’s data was good, especially the unexpected advance of employment. That allows traders to believe that nonfarm payrolls will be better than previously estimated.

ADP employment climbed by 325k in December from November, proving wrong forecasters that expected a drop to 176k from 204k in the preceding month. (Event A on the chart.)

Initial jobless claims were at 372k (seasonally adjusted) last week, near the forecast value of 375k. The reading from the previous week was revised upwardly to 387k from 381k. (Event B on the chart.)

ISM services PMI rose from 52.0% to 52.6% in December, but was below a predicted reading of 53.0. (Event C on the chart.)

Crude oil inventories increased by 2.2 million barrels and total motor gasoline inventories increased by 2.5 million barrels last week. (Event D on the chart.)

Yesterday, a report on factory orders was released, showing an increase by 1.8% in November (in line with forecasts) after a drop by 0.2% in October. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.