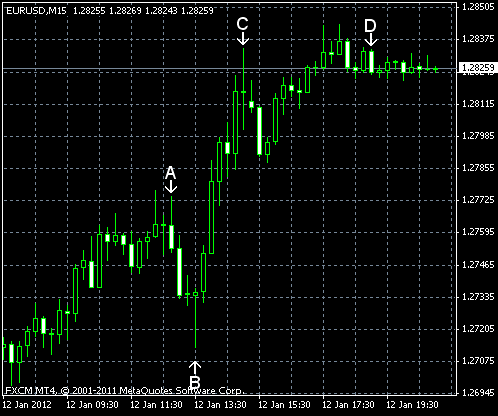

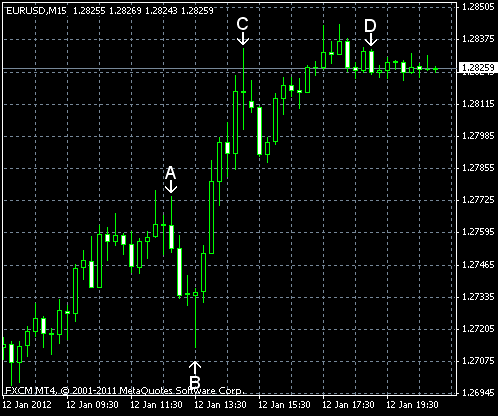

EUR/USD jumped to the highest level this week today after European Central Bank kept its main interest rate unchanged at 1.0% (event A on the chart) and ECB President Mario Draghi said he sees signs that European economy is stabilizing (event B on the chart). Most of today’s reports from the United States were worse than predicted, adding to the weakness of the dollar.

Seasonally adjusted retail sales rose 0.1% in December, according to an advance report. The figure was lower than the median forecast (0.3%) and the November reading (0.4% — revised from 0.2%). (Event B on the chart.)

Seasonally adjusted initial jobless claims unexpectedly rose from 375k to 399k last week. They were expected to remain little changed at 373k. (Event B on the chart.)

Business inventories rose 0.3% in November, compared to the rise by 0.8% in October. Forecasters predicted a 0.4% increase. (Event C on the chart.)

Treasury budget deficit shrank from $137.3 billion in November to $86.0 billion in December. That’s not bad, but market participants were expecting a bigger decrease to $79.0 billion. (Event D on the chart.)

Yesterday, a report on crude oil inventories was released, showing an increase by 5.0 million barrels from the previous week and growth of total motor gasoline inventories by 3.6 million barrels. (Not show on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.