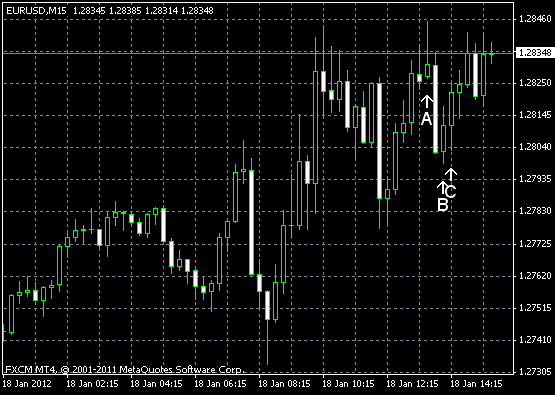

EUR/USD advanced today for the third session as the International Monetary Fund wants to boost its lending resources by $500 billion to safeguard from the global economy from the European crisis. Greek Prime Minister Lucas Papademos will talk with private bondholders to convince them forgive Greece at least half of its debt. Today’s reports from the United States were good for the most part, except the Producer Prices Index that unexpectedly dropped.

PPI declined 0.1% in December, while it was expected to rise by the same rate. The index rose 0.3% in the preceding month. (Event A on the chart.)

Net foreign purchases were $59.8 billion in November. The actual value was well above the average forecast of $27.3 billion and the October reading of $8.3 billion (revised $4.8 billion). (Event B on the chart.)

Industrial production and capacity utilization advanced in December. Industrial production rose 0.4%, much better than the revised November drop by 0.3%. Capacity utilization increased to 78.1% last month from 77.8% in November. Forecasts were near the actual readings: 0.5% and 78.2% respectively. (Event C on the chart.)

Yesterday, a report on NY Empire State Index was released, showing an increase to 13.5 in January from 9.5 in December, while the expected figure was 10.8. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.