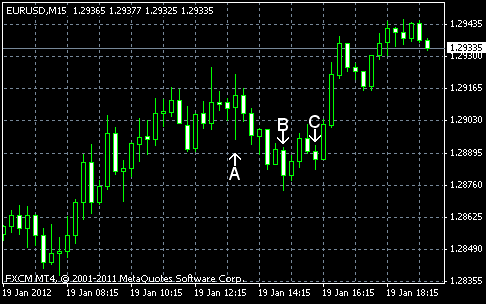

EUR/USD reached today the highest price since January 4 as Spain sold more government bonds than its maximum target at today’s auction, while French borrowing costs fell. It was a bit disappointing day for the United States as reports showed that economic growth and housing sector stalled. On the other hand, jobless claim fell more than was expected.

Housing starts declined to 657k in December (seasonally adjusted) from 685k in November, while market participants hoped them to stay at the same level. Housing starts were at the seasonally adjusted rate of 679k last month, being near 680k in the month and matching forecasts. (Event A on the chart.)

Seasonally adjusted initial jobless claims fell from 402k to 352k in the week ending January 14. That’s a better result that 387k predicted by analysts. (Event A on the chart.)

CPI showed no change in December, following the absence of growth in November. A huge disappointment for traders as a 0.1% growth was expected. (Event A on the chart.)

Philadelphia Fed manufacturing index rose a little from 6.8 in December to 7.3 in January. The December reading was revised down from 10.3. Market anticipated a bigger increase to 10.7. (Event B on the chart.)

Crude oil inventories decreased by 3.4 million barrels, while total motor gasoline inventories increased by 3.7 million barrels last week. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.