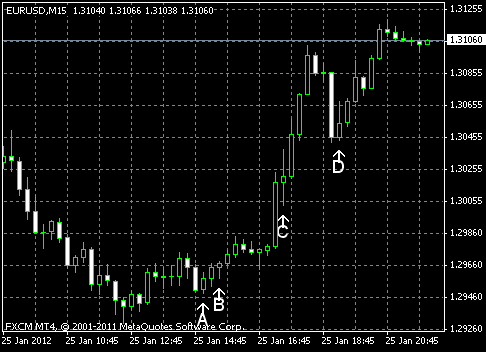

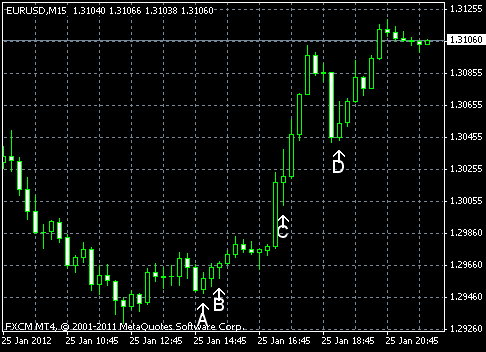

EUR/USD started today’s trading session flat and even began to head down, but rallied after a report showed declining pending home sales. The currency pair was further boosted after the Federal Reserve extended the target for exceptionally low interest rates from mid-2013 to late 2014.

Pending home sales declined 3.5% in December, compared to the median forecast of a 0.6% percent drop. That’s followed the November increase by 7.3%. (Event A on the chart.)

Crude oil inventories increased by 3.6 million barrels, while total motor gasoline inventories decreased by 0.4 million barrels last week. (Event B on the chart.)

The Federal Open Market Committee kept interest rates unchanged near zero (event C on the chart) and reiterated its intention to continue stimulating the economy:

To support a stronger economic recovery and to help ensure that inflation, over time, is at levels consistent with the dual mandate, the Committee expects to maintain a highly accommodative stance for monetary policy.

The FOMC also extended its pledge to keep the rates record low to late 2014. (Event D on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.