EUR/USD was at the highest since December 21 as yesterday’s pledge of the Federal Reserve to keep interest rates low at a prolonged time continued to push the dollar lower. Macroeconomic reports weren’t helping the US currency as housing and jobs data was negative, while leading indicators rose less than expected.

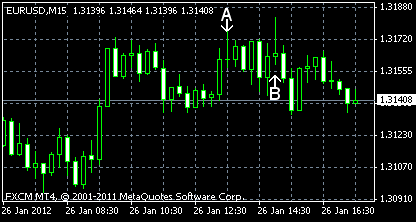

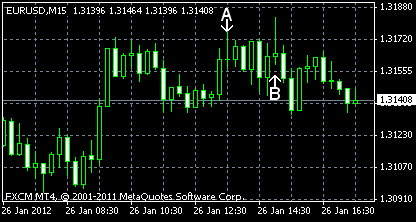

Initial jobless claims (seasonally adjusted) increased from 356k to 377k in the week ending January 21, compared to the median forecast of 371k. (Event A on the chart.)

Durable goods orders increased 3.0% in December, according to the advanced report. Forecasters predicted a 2.1% rise, while the November figure was 4.3% (revised from 3.8%). (Event A on the chart.)

New home sales were down to 307k on a seasonally adjusted basis in January from 314k in November. An increase to 321k was expected by market participants. (Event B on the chart.)

Leading indicators increased 0.4% in December. It’s more than a November growth (0.2%), but less than markets expected (0.7%). (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.