EUR/USD was rising today amid speculations that Greece made progress in talks about

S&P/

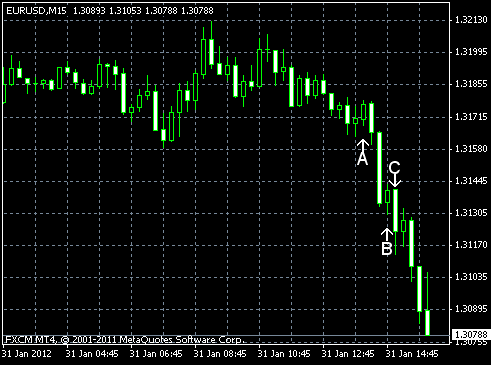

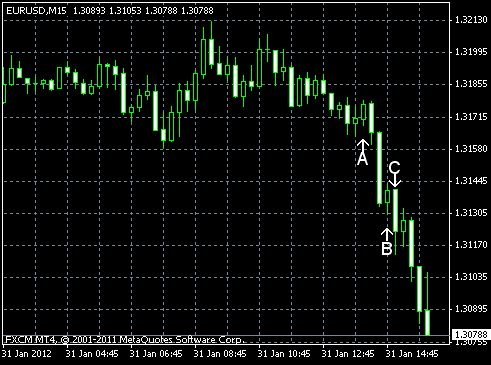

Chicago PMI dropped to 60.2 in January. That was a nasty surprise as market participants expected it to rise to 63.1 from the December figure of 62.5. (Event B on the chart.)

Consumer confidence also frustrated forecasters, falling from 64.8 in December to 61.1 in January, while an increase to 68.2 was predicted. (Event C on the chart.)

Yesterday, a report on personal income and spending was released, showing that incomes rose 0.5%, while spending was almost unchanged in December. Both increase 0.1% in the preceding month.

If you have any comments on the recent EUR/USD action, please reply using the form below.