EUR/USD declined today, following the advance in the beginning of the trading session, as European and Greek politicians are still bickering about the planned bailout for Greece. Greeks blame other European countries of having desire to throw the country out of the European Union, while other EU members blame Greece for not fulfilling its promises. The decline of the currency pair was more a result of the euro weakness rather than strength of the dollar as data from the United States wasn’t very supportive for the US currency. The FOMC meeting minutes were very dovish, suggesting that additional quantitative easing is a definite possibility.

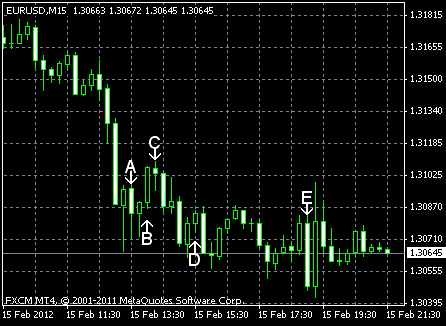

NY Empire State Index rose from 13.5 in January to 19.5 in February, the highest level since June 2010. A smaller increase to 14.7 was predicted by market analysts. The report suggested that expansion of manufacturing continues to gain momentum. (Event A on the chart.)

Net foreign purchases sank to $17.9 billion in December from the November level of $61.3 billion, frustrating forecasters who predicted a smaller decrease to $45.4 billion. (Event B on the chart.)

Industrial production was unchanged in January, missing forecast 0.7 percent growth. An expansion in manufacturing was offset by declines in mining and utilities. Capacity utilization rate was at 78.5%, matching forecast of 78.6%. The December figures was revised upwardly, from 0.4% to 1.0% for production and from 78.1% to 78.6% for utilization. (Event C on the chart.)

US crude oil inventories decreased by 0.2 million barrels and total motor gasoline inventories increased by 0.4 million barrels last week. (Event D on the chart.)

Minutes of the Federal Open Market Committee monetary policy meeting were released today, confirming that the FOMC is going to keep interest rates exceptionally low at a prolonged time (event E on the chart):

In light of the economic outlook, almost all members agreed to indicate that the Committee expects to maintain a highly accommodative stance for monetary policy and currently anticipates that economic conditions–including low rates of resource utilization and a subdued outlook for inflation over the medium run–are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014, longer than had been indicated in recent FOMC statements.

In fact, most FOMC members believed that the US economy may require even more stimulus and only one member thought that pledging to keep accommodative policy beyond near term is inappropriate.

If you have any comments on the recent EUR/USD action, please reply using the form below.