EUR/USD fell today as macroeconomic data showed that the US economy is stabilizing, reducing need for stimulative measures. Housing and consumer confidence data wasn’t very good, but, still, decline of the housing index slowed and consumer sentiment index remained near the highest level in a year. Manufacturing data, on the other hand, was much worse than anticipated.

S&P/

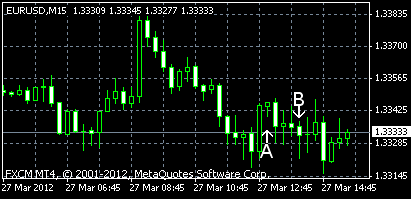

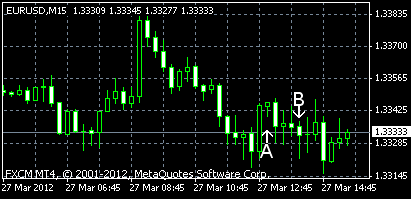

Richmond Fed manufacturing index sank from 20 in February to 7 in March. That’s a much bigger drop than the expected fall to 18. (Event B on the chart.)

Consumer confidence fell from 71.6 in February (revised up from 70.8) to 70.2 in March, in line with analysts’ forecast of 70.3. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.