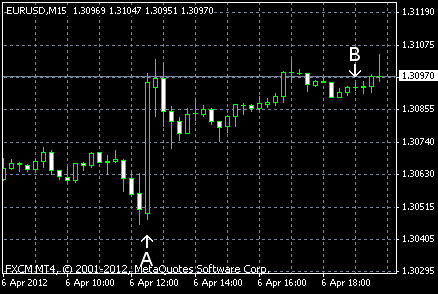

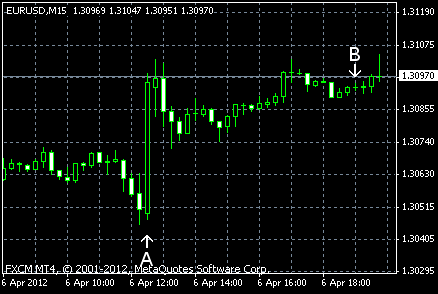

EUR/USD gained today for the first time this week. The currency pair jumped after US nonfarm payrolls showed jobs growth that was far smaller than anticipated. Consumer credit was also below expectations. On the other hand, the previous figures were revised upwardly. Anyway, the poor employment data reignited talks about quantitative easing.

Nonfarm payrolls rose by 120k jobs in March, disappointing traders who anticipated an increase by 207k. The February change was revised from 227k to 240k. Unemployment rate was at 8.2%, while forecasters said it would stay at 8.3%. (Event A on the chart.)

Consumer credit rose by $8.7 billion in February from January, compared to the median estimate of $12.5 billion. The January reading was revised from $17.8 billion to $18.6 billion. (Event B on the chart.)

Yesterday, a report on initial jobless claims was released, showing a decrease from 363k to 357k last week. That’s compared to the predicted 355k. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.