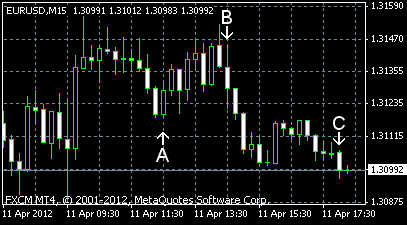

EUR/USD advanced today after the European Central Bank indicated that it’s going to buy Spanish bonds in an attempt to reduce borrowing costs. The currency pair was rising steadily in the first half of the trading session, but stalled and currently declines. As for news from the United States, rising import and export prices together with shrinking budget deficit make this day positive from the fundamental point of view.

Export and import prices rose in March. Export prices advanced 0.8%, following the increase of 0.4% in February. Import prices rose 1.3% after it fell 0.1% in the preceding month (revised from a 0.4% increase), while analysts predicted an increase by 0.8%. (Event A on the chart.)

Crude oil inventories increased by 2.8 million barrels and total motor gasoline inventories decreased by 4.3 million barrels last week. (Event B on the chart.)

Treasury budget balance deficit shrank to $198.2 billion in March from $231.7 billion in February. The expected value was $202.5 billion. (Event C on the chart.)

Yesterday, a report on wholesale inventories was released, showing an increase by 0.9% in February, following the rise by 0.6% in the preceding month (revised from 0.4%). The median estimate was 0.5%. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.