- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: April 13, 2012

April 13

April 132012

Euro Down as ECB Doesn’t Want to Buy Spain’s Debt

The euro fell today as Spanish borrowing costs rose, but the European Central Bank signaled that it’s not going to buy nation’s debt, spurring talks that the debt crisis may spread to Spain. The yield on 10-year Spanish sovereign bond climbed 18 basis points, or 0.18 percentage point, to 6 percent. The cost of insuring against a default in Spain jumped to a record. Klaas Knot, a member of the ECB governing council, said […]

Read more April 13

April 132012

Rand Slips as China’s Economic Growth Slows

The South African rand slid today after the government report showed that China’s economic growth slowed in the first quarter of this year more than market participants expected. Chinese gross domestic product grew 8.1 percent in the first quarter of 2012 from a year ago. That’s compared to the 8.9 percent increase in the previous quarter and market expectation of 8.4 percent growth. The Standard & Poorâs GSCI Index declined 0.4 […]

Read more April 13

April 132012

Will the Great Britain Pound Strengthen Further?

Great Britain pound is showing weakness against the US dollar right now, but it is higher against the euro — and many think that the pound is likely to continue making gains against the the 17-nation currency in the near future. Sterling is struggling against the US dollar, along with other high beta currencies today. Risk appetite is hard to come by with the latest news out of China […]

Read more April 13

April 132012

Won Gains as North Korean Rocket Launch Fails

The South Korean won rose today after North Korean rocket launch failed, easing tensions in the region. The overall positive mood on the Forex market also benefited the currency. South Korean politicians were concerned that the rocket launch was a part of nuclear weapon tests and threatened the country. North Korean claimed that the rocket wasn’t nuclear weapon and carried a satellite as a part of celebration for the centennial of state founder Kim Il Sung. […]

Read more April 13

April 132012

Dollar Index Rises as Risk Appetite Fades on China

It’s been a wild couple of days in the financial markets, with risk appetite returning to some extent and riskier assets favored. Now, though, risk appetite is fading and the US dollar is gaining ground against other majors as disappointing news from China spurs the search for a safe haven. The US dollar index is on the rise again, heading higher as risk aversion rises. Chinese growth appears to be slowing, and that […]

Read more April 13

April 132012

EUR/USD Falls on Rising Spanish Borrowing Costs

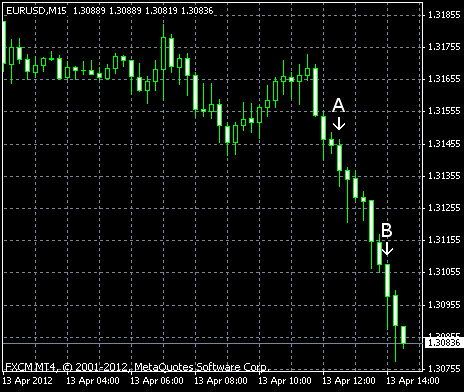

EUR/USD sank today as rising Spanish borrowing costs triggered speculation that the debt crisis is worsening and the European Central Bank needs to restart bond purchases. US inflation grew faster than anticipated, but consumer sentiment unexpectedly worsened. CPI rose 0.3% in March on a seasonally adjusted basis. That’s slower rate of growth than February’s 0.4%, but above the forecast of 0.2%. (Event A on the chart.) Michigan Sentiment Index […]

Read more April 13

April 132012

Loonie Follows Aussie in Advance

The Canadian dollar jumped yesterday and so far has kept its gains today as stocks and commodities advanced on speculation that the Federal Reserve will maintain its interest rates record low for prolonged time. The Canadian dollar followed the Australian dollar that jumped on very good employment data, dragging commodities and commodity-related assets along. Signs that the Fed is going to maintain its stimulating monetary policy are also […]

Read more