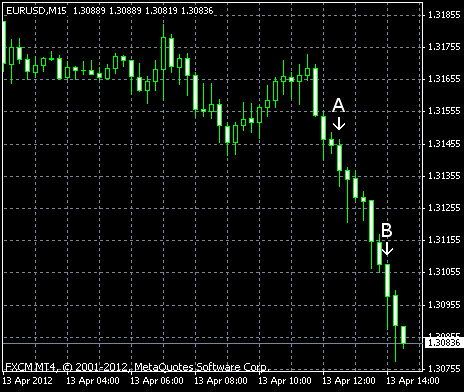

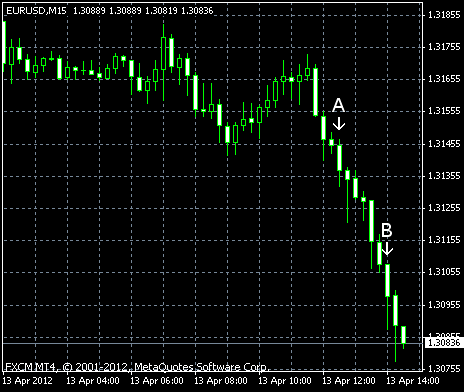

EUR/USD sank today as rising Spanish borrowing costs triggered speculation that the debt crisis is worsening and the European Central Bank needs to restart bond purchases. US inflation grew faster than anticipated, but consumer sentiment unexpectedly worsened.

CPI rose 0.3% in March on a seasonally adjusted basis. That’s slower rate of growth than February’s 0.4%, but above the forecast of 0.2%. (Event A on the chart.)

Michigan Sentiment Index was at 75.7 in April, according to the preliminary estimate, compared to the analysts’ predictions of 76.4. On the other hand, the previous figure was revised from 74.3 up to 76.2. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.