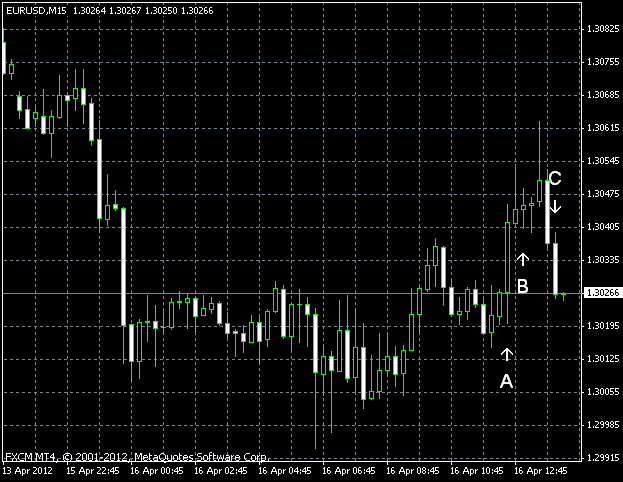

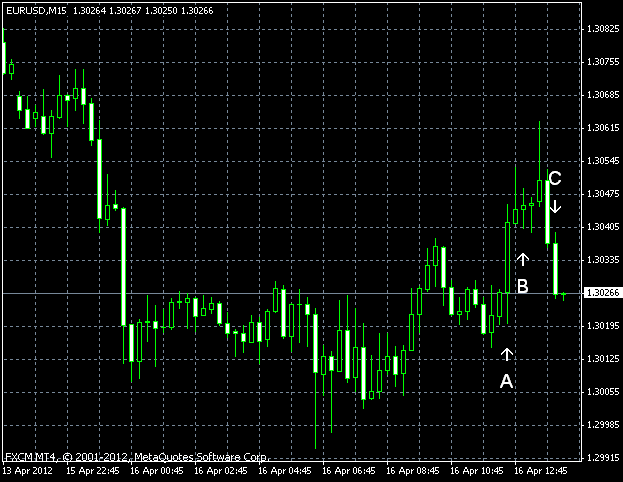

The euro entered a minor rally against the U.S. dollar today, following the release on the improving retail sales in the United States. The currency pair rallied through the negative NY manufacturing index and TIC sales report but stalled later. EUR/USD is still influenced by the uncertainty heated by the ambiguous reports coming out of the world’s biggest economy.

Advance monthly retail sales report showed an increase of 0.8% in March compared to a gain of 1% (revised negatively from 1.1%) in the month of February. The forecast was at 0.3% for this indicator. (Event A on the chart.)

The NY Empire State manufacturing index fell from 20.21 to 6.56 in April, coming out much worse than the consensus forecast of 18. (Event A on the chart.)

Net foreign purchases of the

Business inventories didn’t bring any surprise to markets. They added 0.6% in February as expected, which is only slightly less than 0.7% growth of January. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.