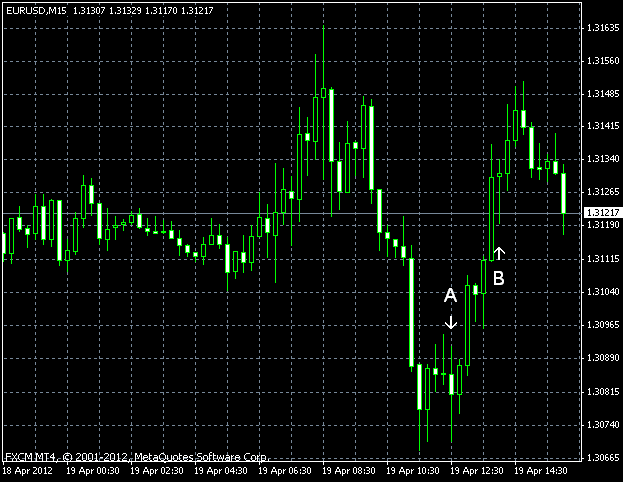

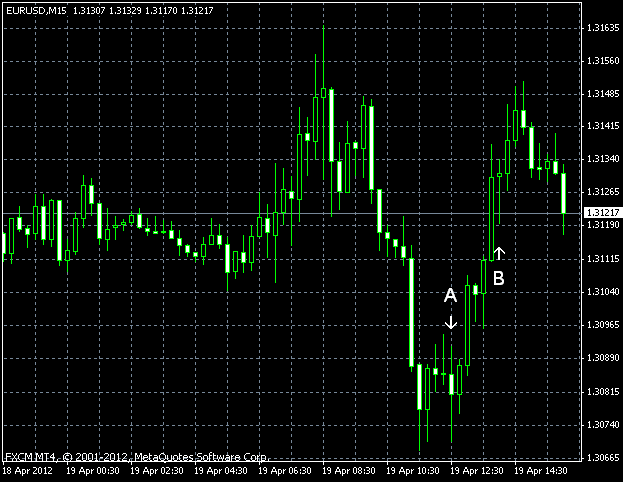

Having fallen significantly during the European trading session, EUR/USD recovered equally rapidly following the

US initial jobless claims went down from 388k (revised negatively from 367k) to 386k last week. The indicator disappointed dollar bulls as the value of 370k was expected from the report. (Event A on the chart.)

Existing home sales unexpectedly fell from 4.6 million to 4.48 million in March according to the National Association of Realtors. An insignificant growt to 4.62 million houses (annual rate) was forecasted. (Event B on the chart.)

Leading indicators were reported to be better than expected for March — they rose by 0.3% vs. 0.2% forecast. Last month, the report showed 0.7% increase. (Event B on the chart.)

Philadelphia Fed business outlook index declined sharply in April — from 12.5 to 8. A slight decline to 12 was expected. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.