EUR/USD gained today after yield on Spanish, Italian and Dutch bonds fell, weakening fears of the European crisis. US manufacturing and housing sectors showed good performance, but that didn’t help consumer confidence that unexpectedly worsened.

S&P/

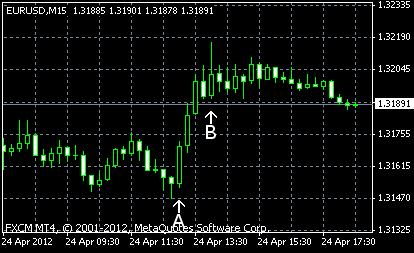

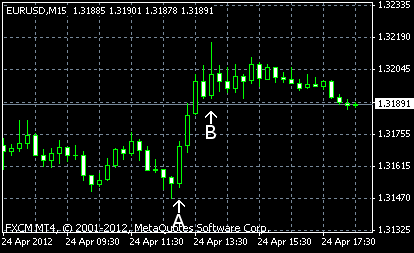

Richmond Fed manufacturing index provided a pleasant surprise for traders rising to 14 in April from 7 in March, even though it was expected to stay unchanged. (Event B on the chart.)

Consumer confidence fell from 69.5 in March (negatively revised from 70.2) to 69.2 in April. The average forecast was 69.9. (Event B on the chart.)

New home sales were at the seasonally adjusted rate of 328k in March. Forecasters expected a smaller figure of 321k. The February reading was revised from 313k to 353k. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.