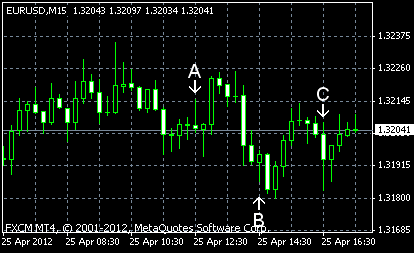

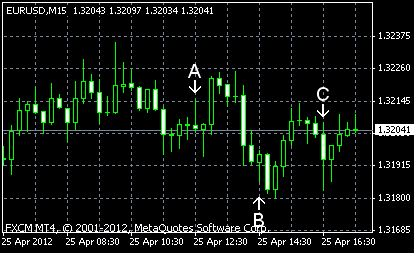

EUR/USD was higher today as falling yields for European bonds had a positive effect on the market sentiment. The euro retained its gains even as the US Federal Reserve hasn’t mentioned quantitative easing in its monetary policy statement. Durable goods orders were also negative for the dollar, falling much more than predicted.

Durable goods orders edged down 4.2% in March. Analysts expected a drop, but only by 1.5%. The February increase was revised from 2.2% to 1.9%. (Event A on the chart.)

Crude oil inventories increased by 4.0 million barrels, while total motor gasoline inventories decreased by 2.2 million barrels last week. (Event B on the chart.)

FOMC said its monetary policy statement that the economy is expanding with moderate and the rate of growth is expected to be moderate for some time. (Event C on the chart.) The statement noted improvement of the employment and housing markets, but added that “the unemployment rate has declined but remains elevated” and “the housing sector remains depressed”. The comments weren’t different from the previous ones and it’s no surprise that the monetary policy remained the same:

The Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions–including low rates of resource utilization and a subdued outlook for inflation over the medium run–are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014.

If you have any comments on the recent EUR/USD action, please reply using the form below.