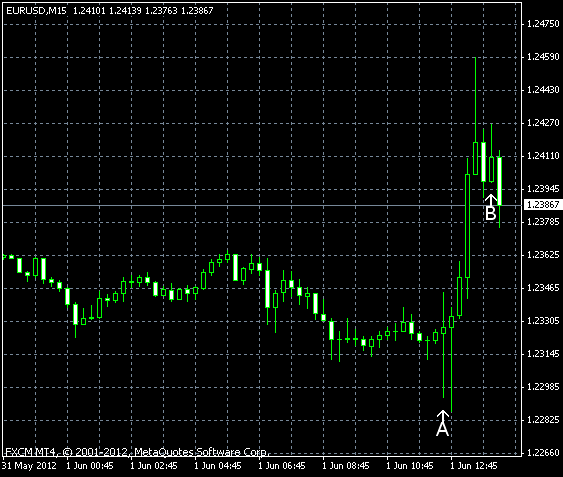

EUR/USD advanced today after reaching the lowest level since July 2010. There are speculations that the European Central Bank may purchase bonds to rein rising borrowing costs. Additionally, macroeconomic data from the USA was unexpectedly bad. Nonfarm payrolls showed that employment growth stalled, supporting case for a new round of quantitative easing from the Federal Reserve.

Employment data from the United States was simply disastrous today. Nonfarm payrolls demonstrated only a marginal growth by 69k in May. That is more that two times below the average forecast of 151k. Another piece of bad news: the April change was revised from 115k down to 77k. And on top of that, unemployment rate rose to 8.2%, while it was predicted to stay at 8.1%. (Event A on the chart.)

Personal income and spending increased in April. Income rose 0.2%, while analysts promised the rate of growth to stay at 0.4% as in March. Spending advanced 0.3%, exactly as was predicted, while the March value was revised from 0.3% to 0.2%. (Event A on the chart.)

ISM manufacturing PMI was down to 53.5% in May from 54.8% in the preceding month. The median estimate was 54.0%. (Event B on the chart.)

Construction spending grew 0.3% in April, the same rate of growth as in March (revised from 0.1%). Economists hoped for somewhat faster growth of 0.4%. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.