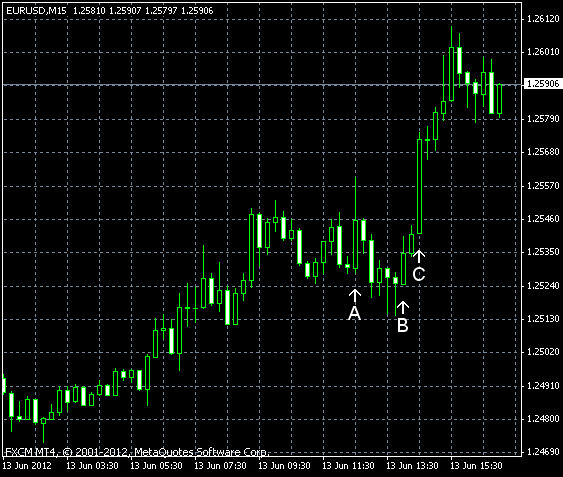

EUR/USD rallied for the second day today amid speculations that European leaders will take every possible effort to keep Greece in the eurozone. Some economists believe that all the negative factors were priced in and the euro has not much room to fall further. At the same time, most of US macroeconomic reports were worse than expected, reducing appeal of the US currency.

PPI fell 1.0% in May. The drop was bigger than the expected 0.6% and the April fall by 0.2%. (Event A on the chart.)

Retail sales fell 0.2% in May, on a seasonally adjusted basis, at the same rate as in April (revised down from a 0.1% increase). Analysts expected a 0.1% decrease. (Event A on the chart.)

Business inventories grew 0.4% in April from March, exactly as forecasters predicted. The March rate of growth was 0.3%. (Event B on the chart.)

Crude oil inventories decreased by 0.2 million barrels last week and are above the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 1.7 million barrels and below the lower limit of the average range. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.