- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 14, 2012

June 14

June 142012

Euro Gains as US Data Sparks Talks About Stimulus

The euro advanced against other major currencies today as poor macroeconomic data from the United States weakened the dollar and spurred speculations that the Federal Reserve will stimulate the economy to support the faltering recovery. The recent streak of negative fundamental reports gave evidence that US recovery is not as robust as many economists were thinking before. The Consumer Price Index was down 0.3 percent in May, while it was […]

Read more June 14

June 142012

US Dollar Index Slips

US dollar index is slipping today as Forex traders find risk appetite, even though there is little good news coming out of Europe. Instead of seeing risk aversion today, there is a bit of risk appetite, and that is sending the US dollar lower against its major counterparts. Also weighing on the US dollar is the possible of an extension of Operation Twist. US economic data continues to offer […]

Read more June 14

June 142012

UK Pound Mixed Today

UK pound is mixed today, gaining against the US dollar, but pulling back against the euro. Risk appetite is making a cautious appearance in the currency markets, even with trouble in the eurozone. Indeed, pound’s fall against the euro is a bit of a surprise after the British currency’s recent gains. Earlier, the UK pound logged gains against the euro, as Fitch warned again that AAA countries in the eurozone could be […]

Read more June 14

June 142012

Rupiah Falls as Moody’s Downgrades Spain, Recovers

The Indonesian rupiah fell today, leading other Asian currencies in decline, after Moody’s Investors Service downgraded Spain’s sovereign-credit rating, refueling concerns caused by the crisis in the countries of the eurozone. Currently the rupiah recovered after the loss. Moody’s announced that it “downgraded Spain’s government bond rating to Baa3 from A3, and has also placed it on review for possible further downgrade”. The reasons for such decision the rating agency cited were: […]

Read more June 14

June 142012

SNB Keeps Libor Unchanged, Reiterates Pledge to Keep Ceiling

The Swiss franc was flat today against the US dollar and fell versus the Japanese yen after the Swiss National Bank maintained its main Libor interest rate and reiterated the pledge to keep the cap on the currency. The SNB kept its benchmark interest rate near zero. Thomas Jordan, the Vice Chairman of the Governing Board, repeated his pledge to keep the currency cap at 1.20 francs per euro. He said: Even at the current […]

Read more June 14

June 142012

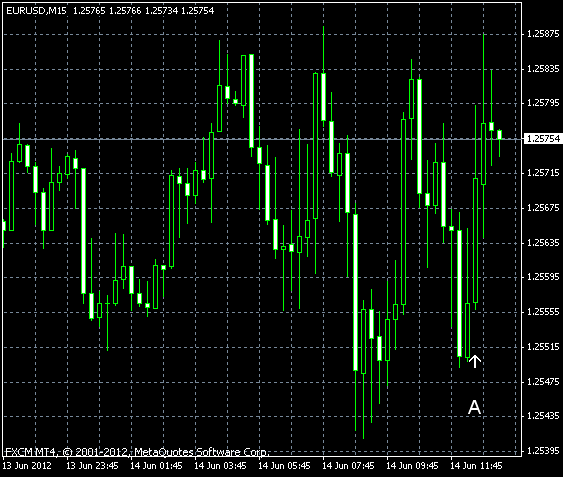

EUR/USD Falls on Spain’s Credit, Recovers on US CPI

EUR/USD retreated today after Moody’s Investor Service downgraded Spain’s credit rating, adding to tensions among investors caused by the coming elections in Greece. The currency pair rebounded after US inflation slowed more than expected and the deficit of US current account was bigger than forecast. Initial jobless claims unexpectedly rose to 386k (on a seasonally adjusted basis) last week from the revised 380k in the week before. Experts said […]

Read more June 14

June 142012

NZ Dollar Gains After RBNZ Keeps Key Rate Stable

The New Zealand dollar started today’s trading session posting gains after the Reserve Bank of New Zealand decided to keep its key Official Cash Rate unchanged and hinted that the economy may expand. The RBNZ left its main interest rate unchanged at 2.5 percent today. Bank’s Governor Alan Bollard mentioned in the statement after the decision the problems in Europe (one of the key trading partners of New Zealand): Political and economic […]

Read more