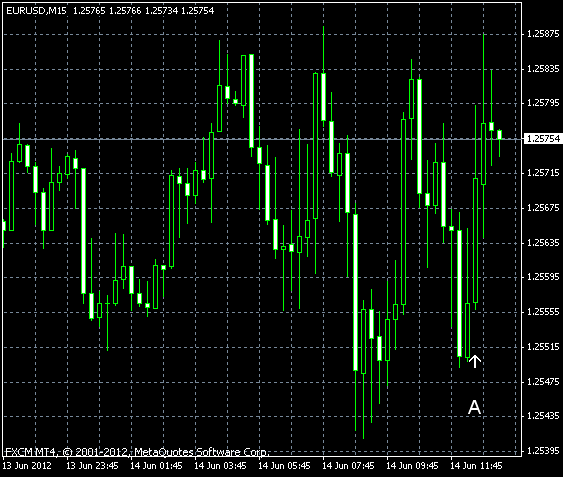

EUR/USD retreated today after Moody’s Investor Service downgraded Spain’s credit rating, adding to tensions among investors caused by the coming elections in Greece. The currency pair rebounded after US inflation slowed more than expected and the deficit of US current account was bigger than forecast.

Initial jobless claims unexpectedly rose to 386k (on a seasonally adjusted basis) last week from the revised 380k in the week before. Experts said the unemployment claims would stay at the unrevised value 377k. (Event A on the chart.)

US CPI was down 0.3% on a seasonally adjusted basis in May, somewhat more than forecasters predicted (0.2%). The index posted no change in April. (Event A on the chart.)

US current account balance posted a deficit of $137.3 billion (preliminary) in the first quarter, up from $118.7 billion (revised) in the previous quarter. The actual reading was above the forecast figure of $132.0 billion. (Event A on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.