- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 20, 2012

June 20

June 202012

Aussie Flat as News from USA & Europe Mixed

The Australian dollar was flat today as the outcome of the Federal Reserve policy meeting was somewhat disappointing and news from Europe was mixed. The Aussie advanced versus the yen, which dropped against all of 16 most-traded currencies. The Fed said that it is going to expand its asset purchase program, replacing short-term bonds with longer term debt. The long-awaited announcement of additional stimulus had not the expected impact […]

Read more June 20

June 202012

Canadian Dollar Falls Even After Fed Extends Operation Twist

The Canadian dollar fell today even after the US Federal Reserve announced that it is going to expand the stimulating measures. The currency surprised traders as it managed to advance versus the Japanese yen. The Fed announced today that it expanded its Operation Twist: The Committee also decided to continue through the end of the year its program to extend the average maturity of its holdings of securities. Specifically, the Committee intends to purchase Treasury […]

Read more June 20

June 202012

Franc, SNB & Euro-Peg: Can Swiss Central Bank Maintain Ceiling?

The Swiss National Bank took an unprecedented step to weaken the franc as it introduced a cap of 1.20 francs per euro back in September 6, 2011. The move followed several years of unsuccessful attempts to devaluate the currency. The announcement immediately met criticism from skeptics who did not believe that such a ceiling is sustainable. Was the intervention successful and, what is even more important, can the central bank to maintain […]

Read more June 20

June 202012

NOK Rises as Norges Bank Signals Rate Hikes are Possible in 2013

The Norwegian krone climbed today after Norway’s central bank left its key policy rate unchanged and signaled that there is a possibility of interest rate hike next year. Norges Bank kept its main interest rate at 1.5 percent today. The bank explained that domestic fundamentals are good, but the European debt issues threaten the nation’s economy: The level of uncertainty surrounding developments in Europe is now […]

Read more June 20

June 202012

UK Pound Gets Boost Against the US Dollar

UK pound is getting a boost today, heading higher against the US dollar as Forex traders sell the greenback ahead of the upcoming FOMC monetary policy announcement. This rebound comes after losses due to Bank of England minutes. Pound is ready to come roaring back against the US dollar, even as it looks for stability against the euro. Earlier in the session, UK pound saw some losses with the release of the Bank […]

Read more June 20

June 202012

Japanese Yen Trades Mixed in Forex Trading

Japanese yen is mixed in Forex trading today, gaining against the US dollar, but moving lower against the euro and the UK pound. Yen received a boost earlier as traders bought on its attractive levels, but the Japanese currency has since pared some of its gains against the US dollar and pulled back against the euro. For the most part, yen trading has been relatively quiet today. Forex traders have […]

Read more June 20

June 202012

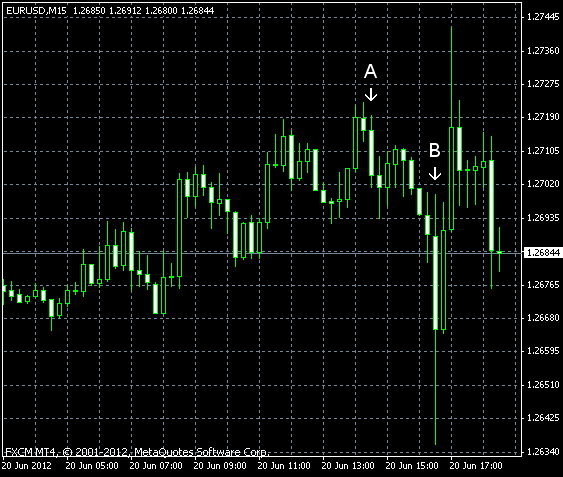

EUR/USD Flat on Conflicting Influence of Fed’s QE & Europe’s Problems

EUR/USD was moving sideways today. It looks like the currency pair is unsure where to go as the impact of the Federal Reserve’s Operation Twist battled with demand for the safety of the US currency caused by problems in Europe. Yesterday’s housing data was positive and supportive for the greenback. Crude oil inventories increased by 2.9 million barrels last week and are above the upper limit of the average range for this time of year. Total motor […]

Read more June 20

June 202012

NZ Dollar Falls on Europe’s Problems, Pares Losses on US QE

The New Zealand dollar fell today on renewed concerns about debt problems in countries of Europe, particularly Spain. The losses were trimmed as anticipation of a third round of quantitative easing from the US Fed lifted traders’ mood. The yield on Spanish bonds maturing in 10 years reached 7.04 percent yesterday. Greece, Ireland and Portugal have required a bailout after their benchmark borrowing costs rose past 7 percent. That means […]

Read more