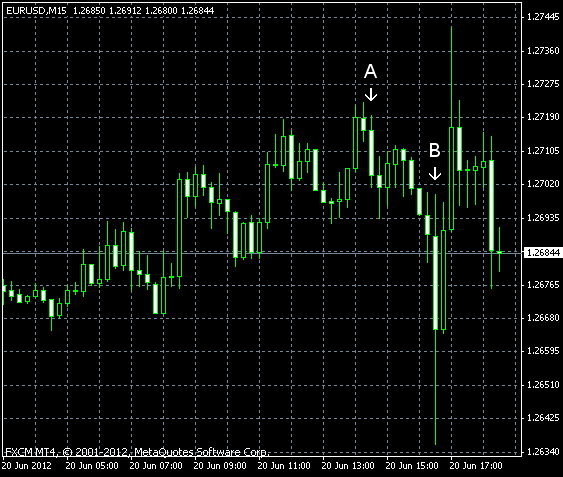

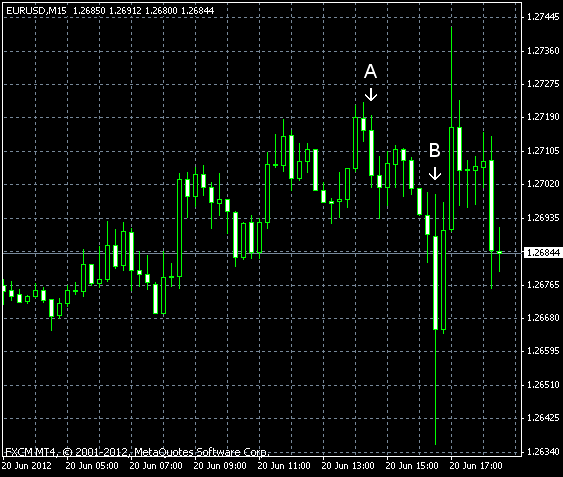

EUR/USD was moving sideways today. It looks like the currency pair is unsure where to go as the impact of the Federal Reserve’s Operation Twist battled with demand for the safety of the US currency caused by problems in Europe. Yesterday’s housing data was positive and supportive for the greenback.

Crude oil inventories increased by 2.9 million barrels last week and are above the upper limit of the average range for this time of year. Total motor gasoline inventories increased by 0.9 million barrels and are in the lower limit of the average range. (Event A on the chart.)

The Federal Open Market Committee extended its stimulating measures as it continued to exchange

The Committee also decided to continue through the end of the year its program to extend the average maturity of its holdings of securities.

Yesterday, a report on housing starts and building permits was released. Housing starts were at the seasonally adjusted annual rate of 708k in May, little changed from the April value of 717k and in line with analysts’ expectations of 720k. Housing starts were at the seasonally adjusted annual rate of 780k in May, above the April reading of 715k and the forecast figure of 720k. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.