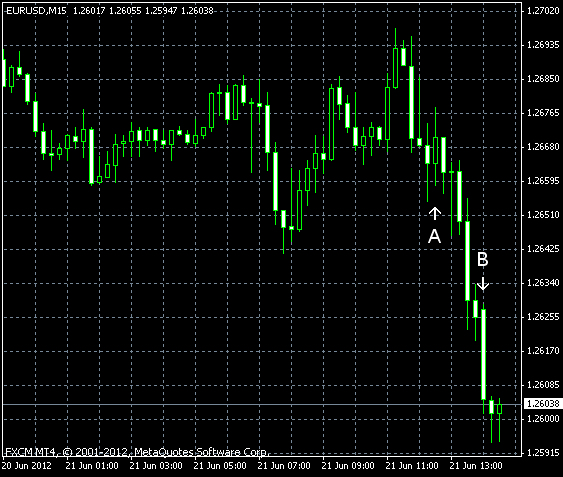

EUR/USD tumbled at today’s trading session as most of economic data from Europe was bad. Fundamentals in the United States were not much better, though, and the dollar still may retreat. Unemployment continued to grow and manufacturing continued to deteriorate.

Initial jobless claims were at the seasonally adjusted rate of 387k last week, little changed from the previous value of 389k, while traders hoped for a decrease to 381k. (Event A on the chart.)

Existing home sales declined to the seasonally adjusted annual rate of 4.55 million in May from 4.62 million in April. The actual reading was near the consensus forecast of 4.58 million. (Event B on the chart.)

Philadelphia Fed Manufacturing Index fell from -5.8 in May to -16.6 in June. That was the second consecutive negative reading that signaled about worsening conditions. The report caught market participants by surprise as a rise to 0.7 was anticipated. (Event B on the chart.)

US leading indicators rose 0.3% in May. The actual figure was a little higher than the predicted 0.2% and noticeably better that the April reading of -0.1%. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.