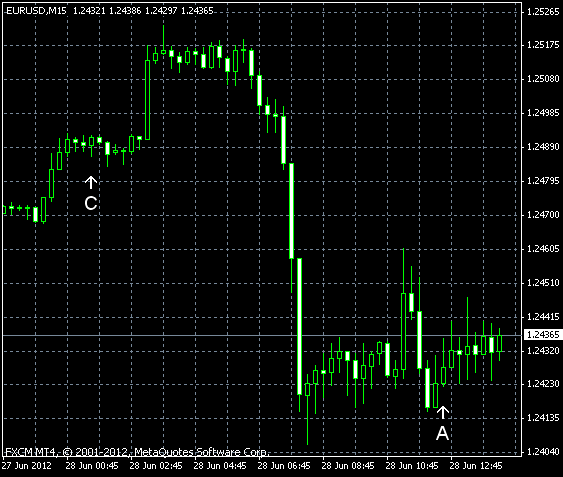

EUR/USD attempted to rally in the very beginning of today’s trading session, but sharply dropped and stayed weak for the rest of the session. The euro is under pressure because of rising yield for Italian bonds and uncertainty about the outcome of the EU summit that started today. US unemployment claims fell, but that is only because of a revision of the previous data. Yet even without the revision the number of the claims would have stayed flat, which is not bad.

Initial jobless claims fell to 396k last week from the previous week’s 392k, being in line with forecasts. The report could be considered good if not the upside revision of the previous reading from 387k. (Event A on the chart.)

GDP grew at the annual rate of 1.9% in the first quarter of 2012, according to the final estimate, which was the same as the preliminary estimate and market expectations. The growth in the fourth quarter of 2011 was at 3.0%. (Event A on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.