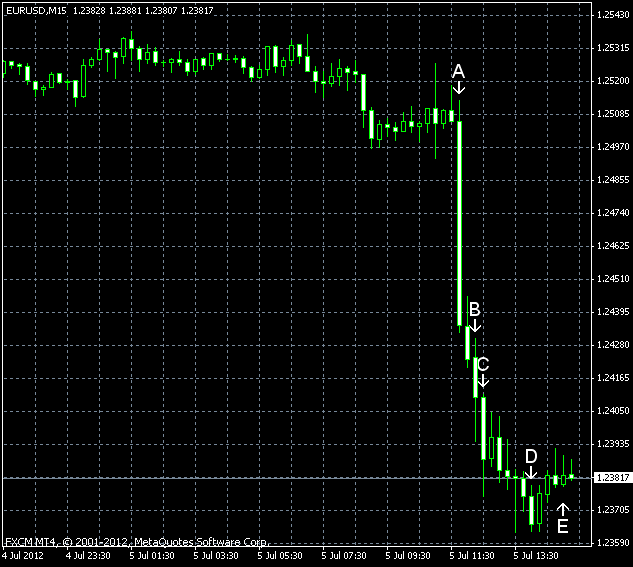

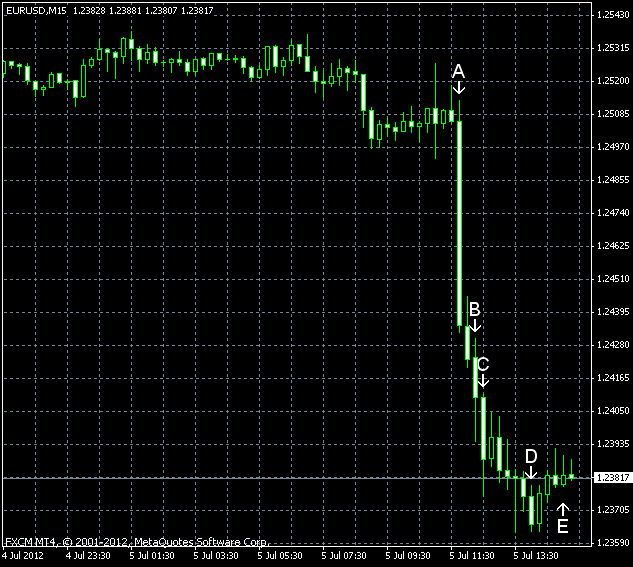

EUR/USD was gradually declining today ahead of the monetary policy meeting of the European Central Bank. The currency pair sharply slumped after the ECB announced that the main interest rate was cut by 25 basis points to 0.75% (event A on the chart). Such decision was expected, but the reaction of the Forex market was strong nevertheless. Employment reports were surprisingly good today, giving hope that nonfarm payrolls, which are released on Friday, would be better than anticipated, meaning that the Federal Reserve may refrain from boosting stimulus. If that will be true, the dollar would likely become much stronger.

ADP employment showed an increase by 176k jobs in June. The actual report was better than the forecast of 103k and the May change by 136k. (Event B on the chart.)

Initial jobless claims fell from 388k to 374k last week, while just a small decrease to 385k was expected by experts. (Event C on the chart.)

ISM services PMI fell from %53.7 in May to %52.1 in June. A figure of 53.1% was expected by traders. A reading above 50.0 indicates expansion. (Event D on the chart.)

Crude oil inventories decreased by 4.3 million barrels last week and are above the upper limit of the average range for this time of year. Total motor gasoline inventories increased by 0.2 million barrels and are below the lower limit of the average range. (Event E on the chart.)

On Tuesday, a report about factory orders was released, showing an increase by 0.7% in May, following two months of decreases, including the 0.7% fall in April. The expectations were for just a 0.1% rise. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.