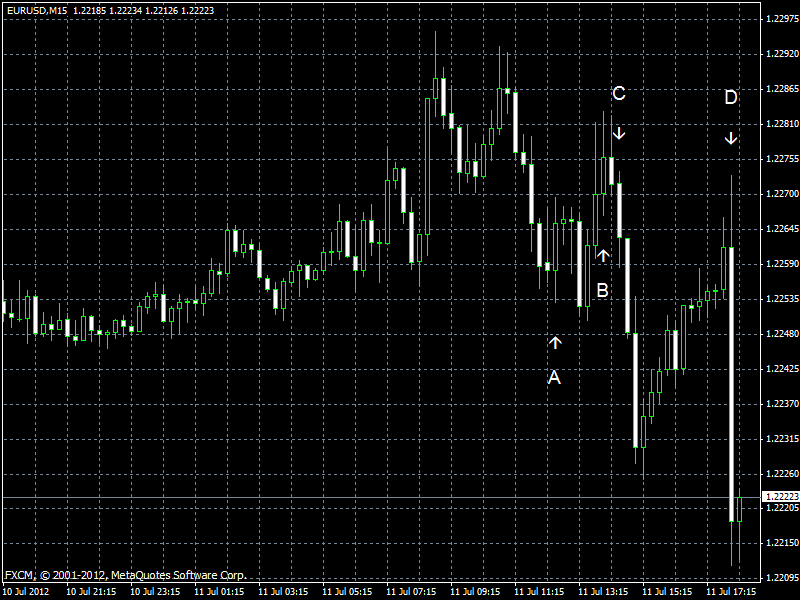

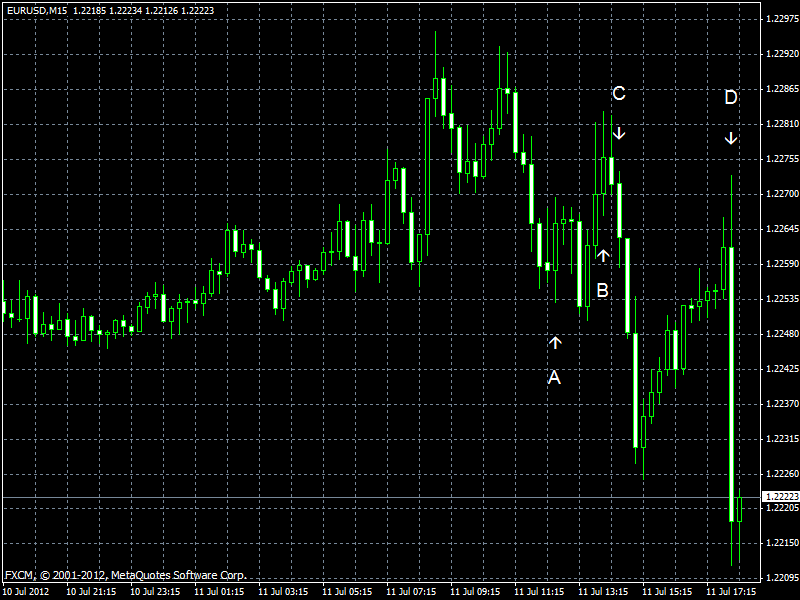

EUR/USD fell sharply after the minutes of the FOMC meeting was released. The reaction of the currency pair was somewhat puzzling as the minutes hinted that policy makers are pessimistic about economic growth and a third round of quantitative easing is a definite possibility. Still, the dollar surged after the release.

US trade balance posted a deficit of $48.7 billion in May. That was a small decrease from $50.6 billion in April and in line with analysts’ forecasts. (Event A on the chart.)

Wholesale inventories rose 0.3% in May. The change was below the market expectations of 0.4% and the April reading of 0.5%. (Event B on the chart.)

Crude oil inventories decreased by 4.7 million barrels last week and are above the upper limit of the average range for this time of year. Total motor gasoline inventories increased by 2.8 million barrels and are in the lower limit of the average range. (Event C on the chart.)

Minutes of the Federal Open Market Committee showed that the members of the FOMC were somewhat dovish. (Event D on the chart.) The minutes said:

A few members expressed the view that further policy stimulus likely would be necessary to promote satisfactory growth in employment and to ensure that the inflation rate would be at the Committee’s goal. Several others noted that additional policy action could be warranted if the economic recovery were to lose momentum, if the downside risks to the forecast became sufficiently pronounced, or if inflation seemed likely to run persistently below the Committee’s

If you have any comments on the recent EUR/USD action, please reply using the form below.