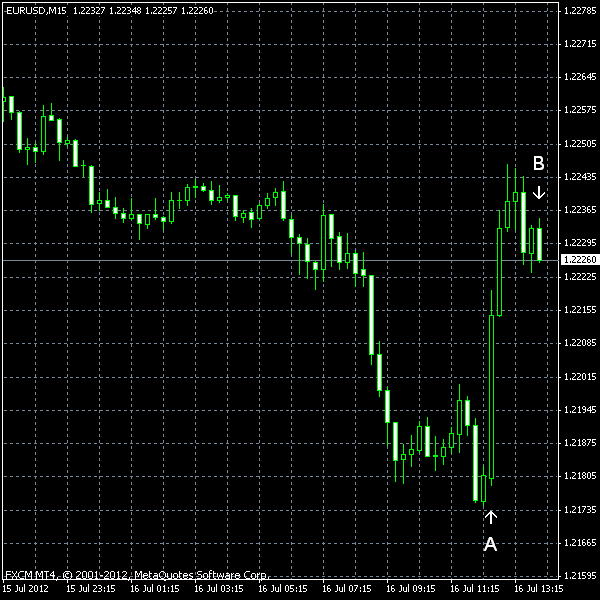

The dollar experienced a rather fast depreciation against its eurozone counterpart today following the release of the fundamental report from the United States. The effect of the retail sales report turned out to be limited. The EUR/USD currency pair declined earlier, moved by the slowdown in the European debt crisis resolving.

Advance retail sales for June 2012 decreased by 0.5% as reported by the US Census Bureau. The drop followed a 0.2% decline registered for the month May and came much worse than the median forecast of 0.2% positive change. (Event A on the chart.)

NY Empire State Index, which is tracking the sentiment in the manufacturing sector of New York, rose from 2.3 in June to 7.4 in July. It surpassed the expected value of 4.0. (Event A on the chart.)

US business inventories rose by 0.3% in May — at the same pace as in April and a bit fast than the forecast (0.2%). (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.