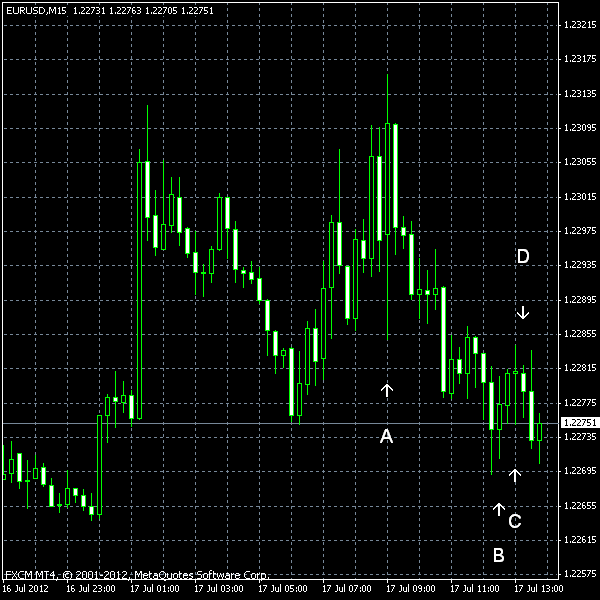

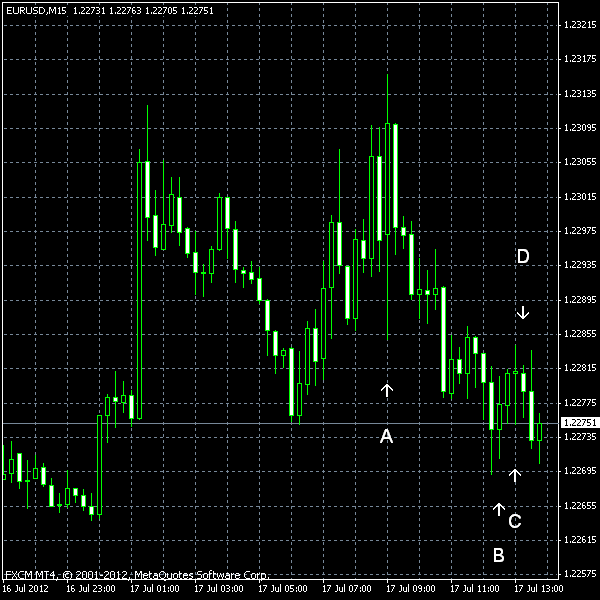

The EUR/USD currency pair went down today after some volatile price spikes generated by the reaction to European ZEW report (event A on the chart.) The euro continued to trade sideways against the US dollar after that, showing little to no acknowledgment of the macroeconomic news from the United States.

US CPI came out unchanged in June on monthly basis. The report was in line with the median forecast and slightly better than the deflation of 0.3% reported for May. (Event B on the chart.)

Net foreign purchases of the US

Industrial production and capacity utilization both demonstrated growth in June. The production increased by 0.4%, following 0.2% drop in May (revised negatively from 0.1% decline) and beating the 0.3% forecast only by one basis point. The utilization rose from 78.7% to 78.9%. Although it is marked as growth in the report, it has certainly disappointed the dollar bulls as the last month’s value was revised down from 79% and a growth to 79.2% was expected. (Event D on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.