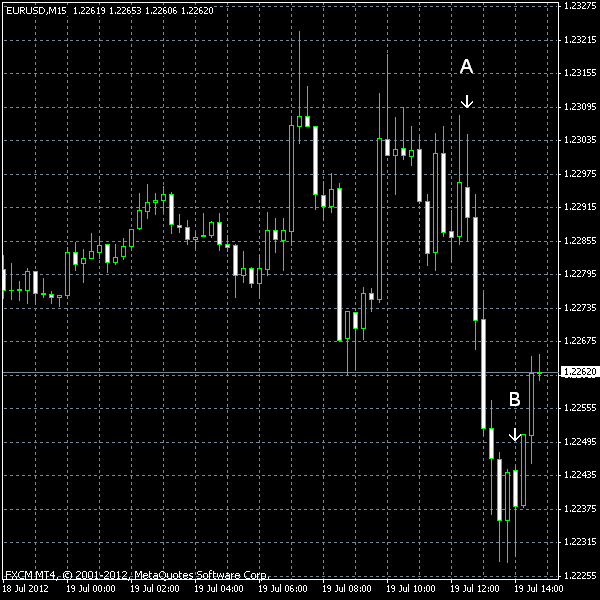

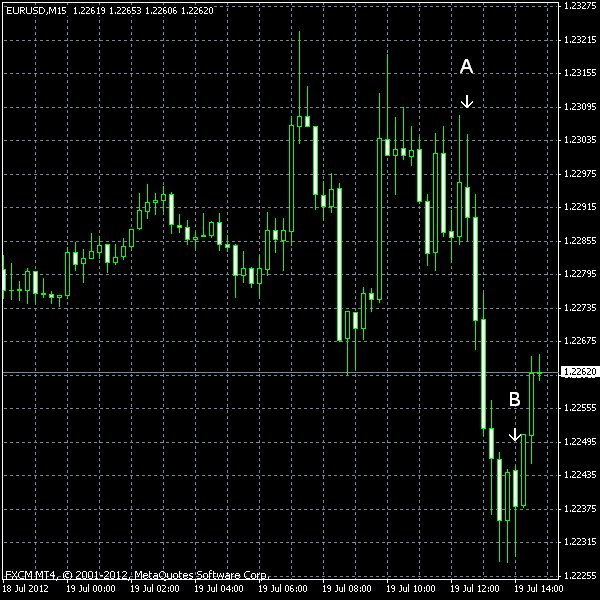

The euro fell surprisingly against the US dollar today following a report on the new unemployment claims that showed a bigger number than the traders had expected. The currency pair traded sideways with some minor volatility before the drop. The rest of the daily US news did not result in much chart action.

Initial jobless claims rose from 352k to 386k last week, while the previous week’s value itself was negatively revised from 350k. Although the analysts expected a growth, they thought it to be lower — only to 365k. (Event A on the chart.)

Existing home sales went down from 4.62 million (seasonally adjusted annual rate) to 4.37 million in June. Previous month’s value was revised from 4.55 million. The market strategists forecasted 4.62 million for June. (Event B on the chart.)

Philadelphia Fed Manufacturing Index increased from -16.6 to -12.9 in July. Still negative and below the median forecast of -8.0. (Event B on the chart.)

Leading indicators fell more than expected in June — by 0.3%. A decline of 0.1% was anticipated. May reading was at 0.4% growth (revised up from 0.3% growth). (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.