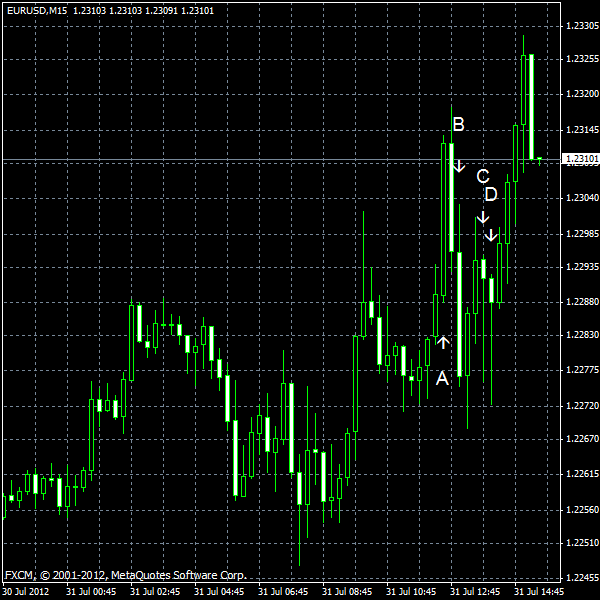

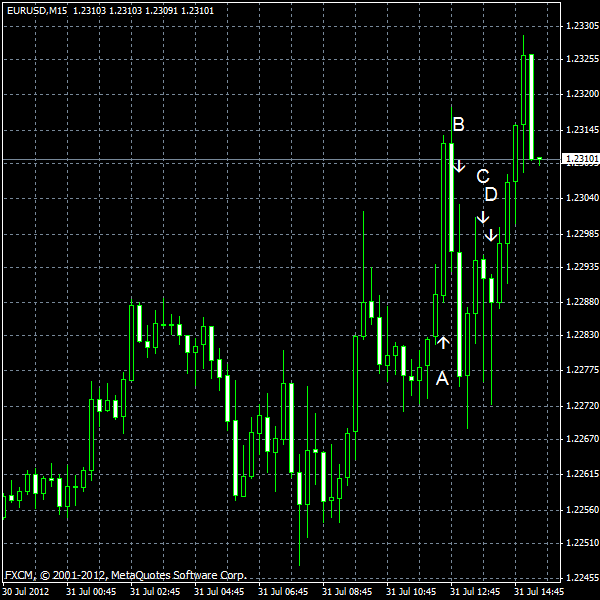

EUR/USD was higher today as traders hoped for monetary easing from both the US Federal Reserve and the European Central Bank later this week. The US data was relatively good today except for personal spending that stalled last month.

Personal income rose 0.5% in June, matching forecasts, after it increased 0.3% in May. Personal income was almost unchanged (posted 0.0% change), while analysts expected an increase by 0.1% and the May estimate showed a 0.1% drop. (Event A on the chart.)

S&P/

Chicago PMI rose from 52.9 in June to 53.7 in July. The increase surprised market participants pleasantly as they expected a decrease to 52.6. (Event C on the chart.)

Consumer confidence edged up to 65.9 in July from 62.7 in June. Another pleasant surprise as analysts’ estimates promised a drop to 61.5. The report said, though, that the confidence remained at historically low levels. (Event D on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.