- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: August 1, 2012

August 1

August 12012

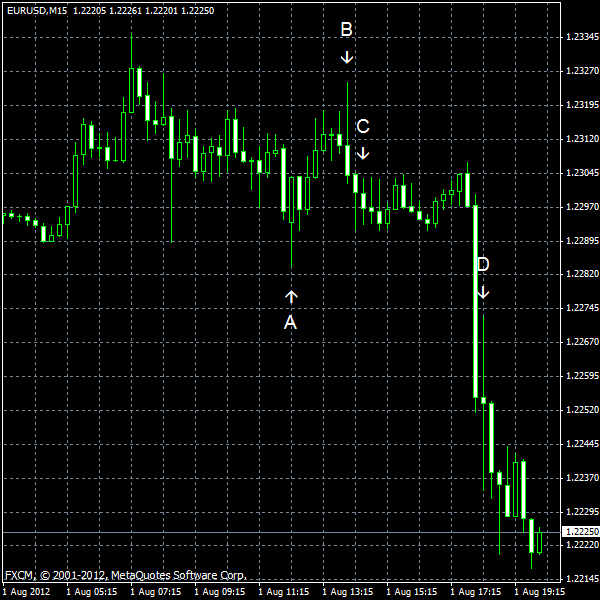

No QE from Fed Means Stronger Dollar

The US dollar jumped today after the Federal Reserve decided, following the two-day policy meeting, to refrain from performing a new round of quantitative easing. The Fed was not very optimistic about economic growth. The Federal Open Market Committee said in its statement: The Committee expects economic growth to remain moderate over coming quarters and then to pick up very gradually. Consequently, the Committee anticipates that the unemployment rate will […]

Read more August 1

August 12012

Euro Waits for Central Bank News

Euro is fairly steady today, as the world waits for central bank decisions. While euro has slipped a little against the US dollar, it is still holding its own. Euro is higher against the pound and the yen. Right now, the main focus is the meeting by European Central Bank policymakers. A policy announcement is expected tomorrow, and it is expected to focus on helping the eurozone stabilize. Some are hoping […]

Read more August 1

August 12012

UK Pound Weaker on Economic Data

Central bank decisions are on the way this week, but that isn’t helping the UK pound much. Indeed, another dismal manufacturing report is dragging on the pound today. The UK recession seems to be deepening, and there is no way that the Olympics are going to be able turn things around. UK pound is headed lower today, as concerns about the economy rise. Housing data, as well as manufacturing […]

Read more August 1

August 12012

Indonesian Rupiah Declines While Trade Deficit Expands

The Indonesian rupiah fell today after the report showed that exports fell, leading to a bigger-than-expected trade balance deficit and declining attractiveness of the currency. Indonesia’s trade deficit was at $1.3 billion in June, being almost double the predicted amount of $530 million. Exports fell as much as 16.4 percent from a year ago, demonstrating the biggest drop since September 2009. Inflation picked up to 4.56 percent in July, reaching the fastest expansion […]

Read more August 1

August 12012

Yuan Declines on PMI Figure

The Chinese yuan fell today after the worse-than-expected manufacturing report. The uncertainty about the policy decisions of the Federal Reserve and the European Central Bank also made traders reluctant to buy risky currencies. The China Federation of Logistics and Purchasing reported that Manufacturing Purchasing Managers’ Index was at 50.1 in July, while market participants hoped for the figure of 50.4. The yuan fell after the report even as the Peopleâs Bank of China raised the reference rate by 0.02 […]

Read more August 1

August 12012

EUR/USD Drops as Fed Disappoints Markets

EUR/USD slumped today after the Federal Reserve disappointed Forex traders as it refrained from stimulus. The Fed said it would continue to do what it has promised earlier, namely keeping the rates low till at least the late 2014 and extending the average maturity of its securities. Yet that was not market participants were hoping for, making the dollar stronger. Tomorrow, the European Central Bank will announce […]

Read more