EUR/USD slumped today after the Federal Reserve disappointed Forex traders as it refrained from stimulus. The Fed said it would continue to do what it has promised earlier, namely keeping the rates low till at least the late 2014 and extending the average maturity of its securities. Yet that was not market participants were hoping for, making the dollar stronger. Tomorrow, the European Central Bank will announce its policy decision and that may overshadow the Fed’s statement. The macroeconomic picture in the United States looks mixed as manufacturing declined for a second month, but employment grew more than expected.

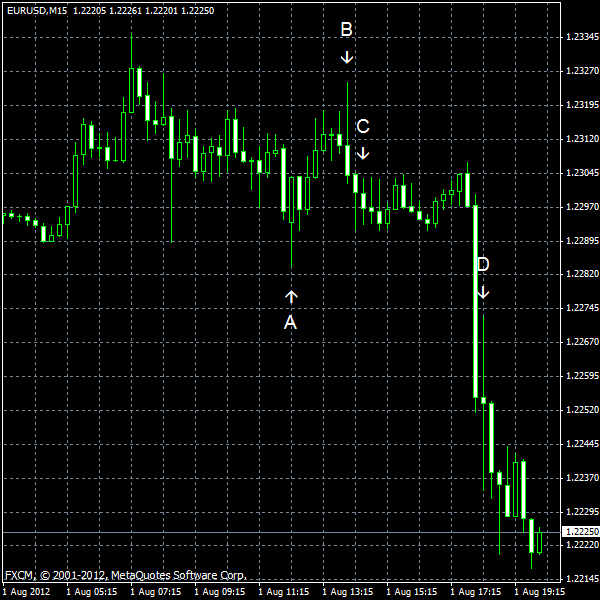

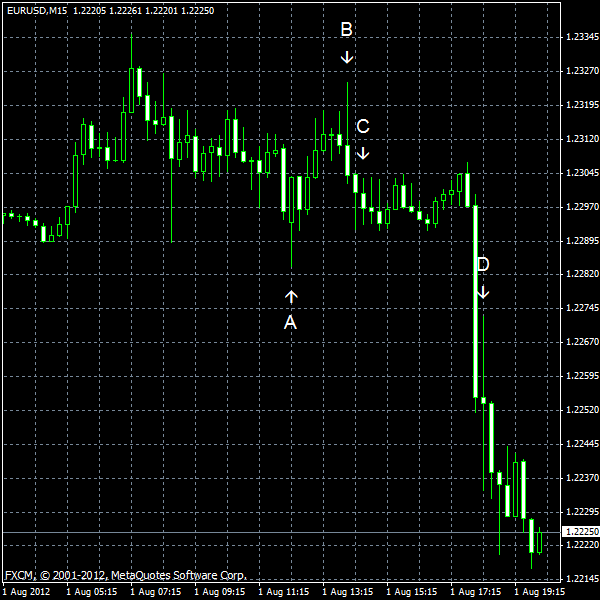

ADP employment increased by 163k from June to July, on a seasonally adjusted basis. The reading was below the June growth by 172k, but above the expected figure of 121k. (Event A on the chart.)

ISM manufacturing PMI was at 49.8% in July, little changed from the June value of 49.7%, indicating the second contraction of manufacturing in a row since July 2009. The report frustrated market participants who expected an increase to 50.3%. (Event B on the chart.)

Construction spending (seasonally adjusted) rose 0.4% in June from May, in line with the analysts’ forecast of 0.5%. The May advance was revised from 0.9% up to 1.6%. (Event B on the chart.)

Crude oil inventories decreased by 6.5 million barrels last week and are above the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 2.2 million barrels and are in the lower half of the average range. (Event C on the chart.)

The Federal Open Market Committee spoke in today’s statement about slower economic growth and signaled that it is ready to take appropriate measures if they would be necessary, but refrained from immediate actions. (Event D on the chart.) The FOMC said it would continue to extend maturities of its bond holdings:

The Committee also decided to continue through the end of the year its program to extend the average maturity of its holdings of securities as announced in June

If you have any comments on the recent EUR/USD action, please reply using the form below.