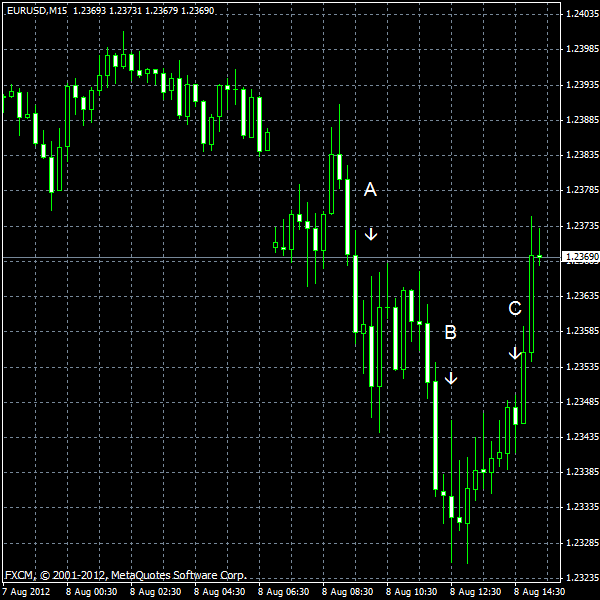

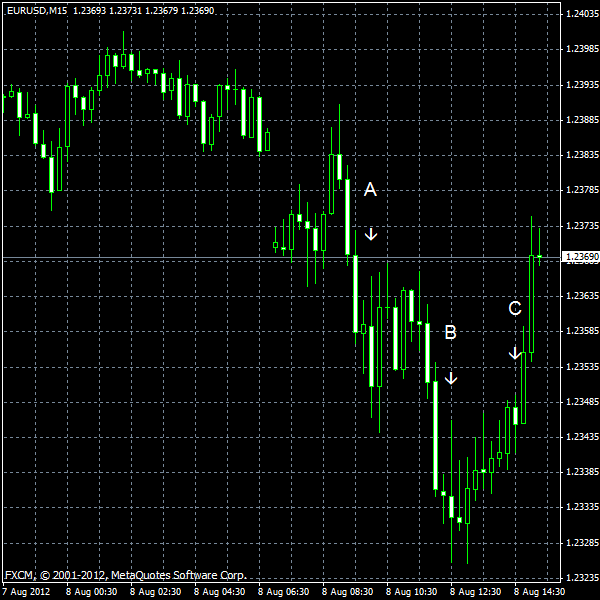

EUR/USD fell today as the decline of German industrial production added to evidences that the European economy is stalling. (Event A on the chart.) As of now, the currency pair trimmed some of its losses and attempts to rally.

Preliminary nonfarm productivity rose 1.6% in the second quarter from a year ago, in line with forecasts of 1.5%. The drop in the first quarter was revised from 0.5% to 0.9%. (Event B on the chart.)

Crude oil inventories decreased by 3.7 million barrels last week and are above the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 1.8 million barrels and are in the lower half of the average range. (Event C on the chart.)

Yesterday, the report on consumer credit was released, showing the increase by $6.5 billion (seasonally adjusted) in June from May. The value was much smaller than the expected $11.5 billion and the revised May increase of $16.7 billion. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.