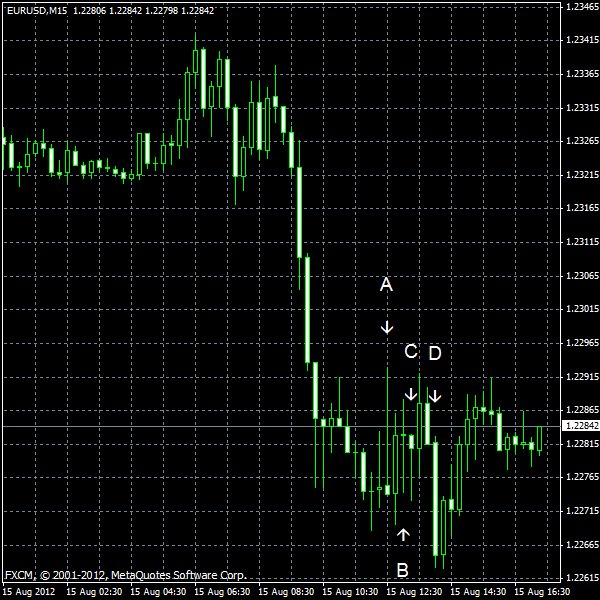

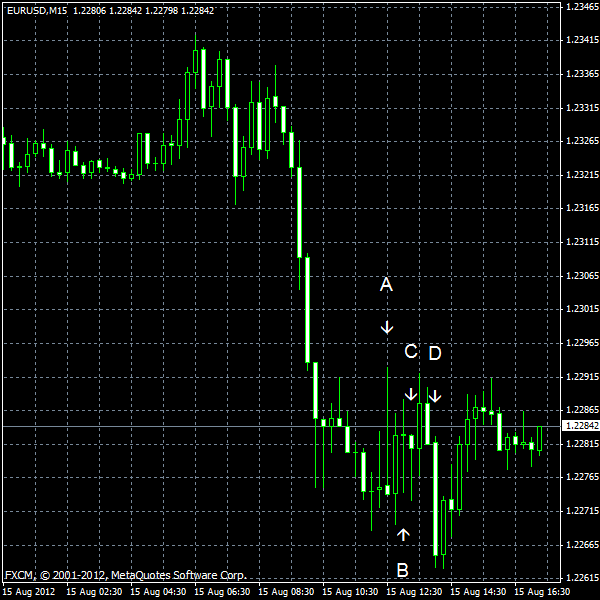

EUR/USD was flat at the beginning of today’s session, but dropped sharply as of 9:00 GMT. As of now, the euro continues its sideways move, keeping the losses, but not falling further. Most of today’s reports from the United States were disappointing. The only good data came from industrial production, which was rising last month, and even here traders saw some negativity as the earlier reading was revised downwardly.

CPI posted no change in July, as well as in June, while economists hoped for 0.2% growth. (Event A on the chart.)

NY Empire State Index fell to -5.9 in August, falling below zero for the first time since October 2011. Much smaller drop from 7.4 to 6.6 was expected by market participants. (Event A on the chart.)

Net foreign purchases fell to $9.3 billion in June. Another disappointment for markets as decrease from $55.9 billion to $49.5 billion was expected. (Event B on the chart.)

Industrial production and capacity utilization expanded in July. Industrial production rose 0.6% in July, while the June’s reading was revised from 0.4% to 0.1%. The median forecast was 0.5%. Capacity utilization was at 79.3%, matching forecasts and being near the previous figure of 78.9%. (Event C on the chart.)

Crude oil inventories decreased by 3.7 million barrels and are above the upper limit of the average range for this time of year last week. Total motor gasoline inventories decreased by 2.4 million barrels and are in the lower half of the average range. (Event D on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.