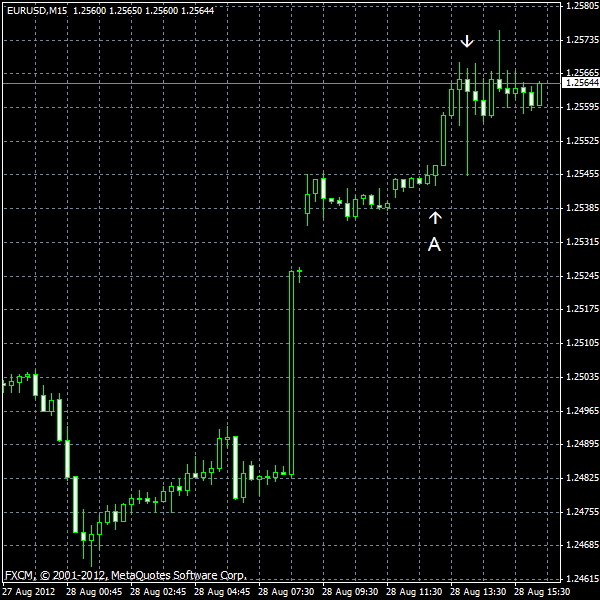

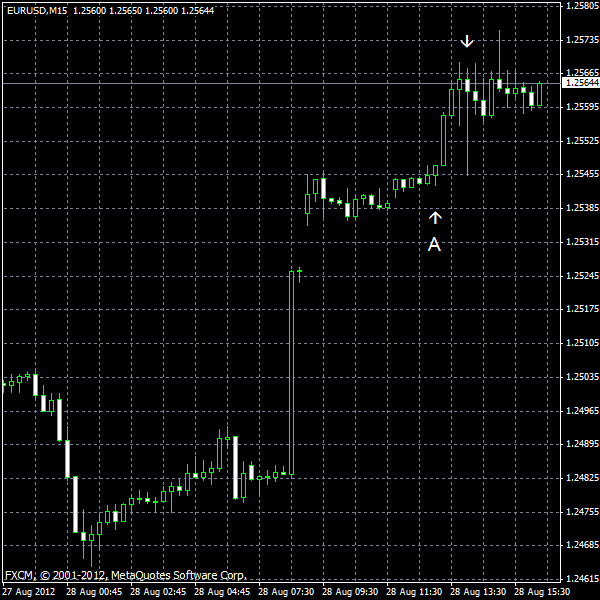

EUR/USD traded above the opening level today, following two session of decline, on speculations that Spain would get a bailout soon and as the country successfully performed its bill auction. The US fundamentals were mixed. Data confirmed that the US housing market is recovering, while manufacturing contracted with slower pace. At the same time, consumer sentiment unexpectedly worsened this month.

S&P/

Richmond Fed manufacturing index ticked up from -17 in July to -9 in August. The actual data was better than the predicted value of -11. (Event B on the chart.)

Consumer confidence fell to 60.6 in August. That reading is worse than the expected 65.8 and the July figure of 65.4 (revised down from 65.9). (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.